NCC Share Price Today: Live NSE/BSE Update (2 Feb 2026)

Introduction: Why NCC share price matters

The NCC share price is closely watched by investors and market observers as a barometer of sentiment in the construction and infrastructure sector. On 2 February 2026, live quotes from major platforms show modest movement in the stock, underlining ongoing intraday volatility that can affect short‑term traders and long‑term holders alike.

Main body: Latest quotes and intraday activity

Opening, previous close and intraday range

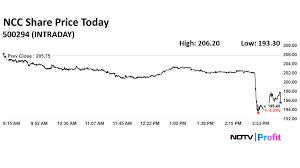

According to live NSE/BSE graph & chart data, NCC opened the trading session at ₹147.5, after a previous close of ₹146.4. During the day, the share price traded in a range between ₹142.92 and ₹151.95, reflecting intra‑session swings that typify the stock’s short‑term volatility.

Current price and recent change

Market data aggregators report the NCC share price as ₹147.61 as on 2 February 2026. TradingView shows the same current quote of ₹147.61 and notes a decrease of −0.23% over the past 24 hours. Tickertape similarly highlights that prices are volatile and change throughout the trading day depending on multiple factors.

What the numbers indicate

The small net change from the previous close to the current quote suggests limited directional momentum in the immediate term, while the intraday high of ₹151.95 and low of ₹142.92 indicate that buyers and sellers were active across a roughly ₹9 range. Such swings can present both risk and opportunity: they may offer entry or exit points for traders but can increase uncertainty for cautious investors.

Conclusion: Takeaways and outlook for readers

In summary, the NCC share price stood at ₹147.61 on 2 Feb 2026, down −0.23% in the past 24 hours, with an intraday trading band of ₹142.92–₹151.95 and an opening level of ₹147.5 (previous close ₹146.4). Investors should monitor live NSE/BSE feeds and charting tools for real‑time movement and consider the stock’s volatility when making decisions. Given the observed intraday swings, short‑term traders may find opportunities in price action, while long‑term investors should weigh broader fundamentals beyond intraday fluctuations.