jio finance share: Latest price, valuation and outlook

Introduction: Why jio finance share matters

The performance of the jio finance share is closely watched by investors and market observers because Jio Financial Services is a core investment company tied to the larger Jio ecosystem. Its stock reflects not only standalone financial-services prospects but also strategic positioning within Reliance Industries’ digital and consumer platforms. Given its market capitalization and valuation metrics, movements in this stock can influence sentiment around India’s financial-technology and lending segments.

Main body: Current facts and market indicators

Price and market metrics

As of the latest available quotes, the jio finance share trades at about ₹263 (TradingView: ₹263.45), up roughly 0.43% in the past 24 hours. Market capitalization stands at approximately ₹1,66,865 crore. The stock’s 52-week high/low range reported in summaries is ₹339/₹199, showing the extent of intra-year volatility.

Valuation and balance-sheet pointers

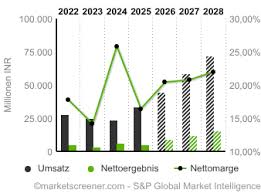

Valuation metrics show a relatively high price-to-earnings ratio: Screener lists a P/E of 105, while other summaries (JIOFIN-IN) report a trailing P/E around 96.5, indicating some variance across data providers but a consistently elevated valuation relative to many peers. Book value is reported near ₹212 per share. Dividend information is noted in event calendars, with a dividend date referenced as 08/11/2025, though specific yield figures are not detailed in the provided summaries.

Business profile and recent news

Jio Financial Services is described as a core investment company that provides full-stack financial services through consumer-facing entities. It operates via subsidiaries such as Jio Finance Limited (JFL) and Jio Leasing Services Limited (JLSL), offering digital lending and operating lease solutions to customers and merchants. Some sources indicate there is no recent news impacting the security at the time of these snapshots.

Conclusion: Takeaways and what to watch

The jio finance share commands significant market value and a high valuation multiple, reflecting investor expectations for growth from its digital-finance initiatives. For readers and investors, key items to monitor include quarterly earnings, lending portfolio performance, developments within the Jio ecosystem that drive customer adoption, and the announced dividend date. This information provides context but is not investment advice; prospective investors should consult full disclosures and their financial advisers before acting.