shanghai silver price: Drivers, trends and outlook for China

Introduction: Why shanghai silver price matters

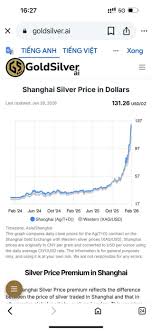

The shanghai silver price functions as a central benchmark for China’s precious metals market, influencing manufacturers, traders and investors. As the world’s largest industrial metals consumer, shifts in China’s silver price can affect global supply chains, electronics and photovoltaic sectors, and the strategies of bullion investors. Understanding the dynamics behind the shanghai silver price is therefore essential for market participants and policy observers.

Main body: Key factors shaping the market

Market structure and instruments

Silver in China is traded both on the Shanghai Futures Exchange (SHFE) and in physical markets. Futures contracts, onshore spot trading and warehouse inventories together determine local pricing. The interplay between SHFE prices and international benchmarks such as the London Bullion Market Association (LBMA) spot price frequently sets premiums or discounts, reflecting delivery, transportation and currency factors.

Demand and supply drivers

Industrial demand is a major influence: electronics, solar photovoltaic panels and medical applications consume substantial amounts of silver. Economic activity in manufacturing and construction therefore has a direct impact on the shanghai silver price. On the supply side, mine production, recycling of industrial scrap and imports affect available metal. Changes in Chinese mine output or import policy can quickly alter local market balances.

Monetary and currency influences

Broader monetary conditions and the strength of the Chinese yuan relative to the US dollar matter for metal prices. Global monetary policy expectations, interest rates and inflation data influence precious metals’ appeal as a store of value. A weaker yuan can raise local silver prices in RMB terms even if global dollar-denominated prices are stable.

Logistics, inventories and regulation

Warehouse stocks and freight costs determine short-term physical tightness. Regulatory actions, including import quotas, environmental inspections at mine sites or changes to exchange trading rules, can cause abrupt price movements or shifts in liquidity.

Conclusion: Outlook and implications

The shanghai silver price will remain sensitive to China’s industrial activity, exchange inventory levels and global macro trends. Short-term volatility is likely as markets react to economic data, policy shifts and currency moves. For manufacturers and traders, close monitoring of SHFE data and physical warehouse figures is crucial. Investors should combine onshore signals with global benchmarks to form a comprehensive view. Over the medium term, China’s demand trajectory for electronics and clean-energy technologies will be a key determinant of where the shanghai silver price heads next.