Understanding Newgen Share Price Trends and Performance

Introduction

The share price of companies serves as a vital indicator of their market value and investor sentiment. For Newgen Software Technologies Ltd., a prominent player in the software solutions sector, the dynamics of its share price are critical for investors and stakeholders. Understanding these trends is essential in making informed investment decisions, especially amidst the volatile stock market landscape.

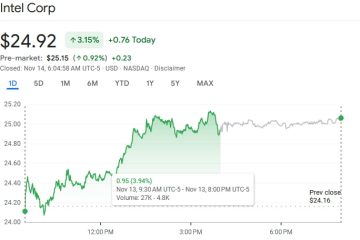

Current Share Price Overview

As of the latest trading session on October 16, 2023, Newgen’s share price stood at approximately ₹400 per share. Over the past month, the stock has experienced fluctuations influenced by various market factors, including earnings announcements, overall market sentiment, and broader economic indicators. Analysts have reported a 5% increase in the stock price over the last quarter, concluding that the company’s strong performance reports have positively impacted investor confidence.

Factors Influencing Newgen Share Price

Several factors contribute to the movements in Newgen’s share price. The company has recently announced a series of strategic partnerships and product launches which are anticipated to drive future growth. Furthermore, increasing demand for digital transformation solutions amid the global shift towards remote operations has bolstered Newgen’s market position.

Additionally, macroeconomic factors, such as inflation rates and changes in monetary policy, have also played a significant role in influencing stock performance. As the Reserve Bank of India maintains a vigilant stance on inflation control, investors are closely monitoring these shifts which could impact Newgen’s operational costs and pricing strategies.

Market Sentiment and Analyst Recommendations

Market analysts are currently optimistic about Newgen’s future prospects. Major brokerage firms have rated its stock as a ‘buy’ with a target price estimate of ₹450, suggesting a healthy upside potential. The optimism stems from the company’s robust revenue growth and innovative solutions that are gaining traction among various sectors, including banking and finance.

Conclusion

In summary, Newgen’s share price is influenced by a variety of internal and external factors, including recent business developments, investor sentiment, and macroeconomic conditions. For investors, keeping a close watch on these trends is imperative to navigate potential risks and opportunities. As the company continues to expand its product offerings and capture market share, its stock could present viable prospects for those seeking to invest in the technology sector.