Current Trends in South Indian Bank Share Price

Importance of South Indian Bank Share Price

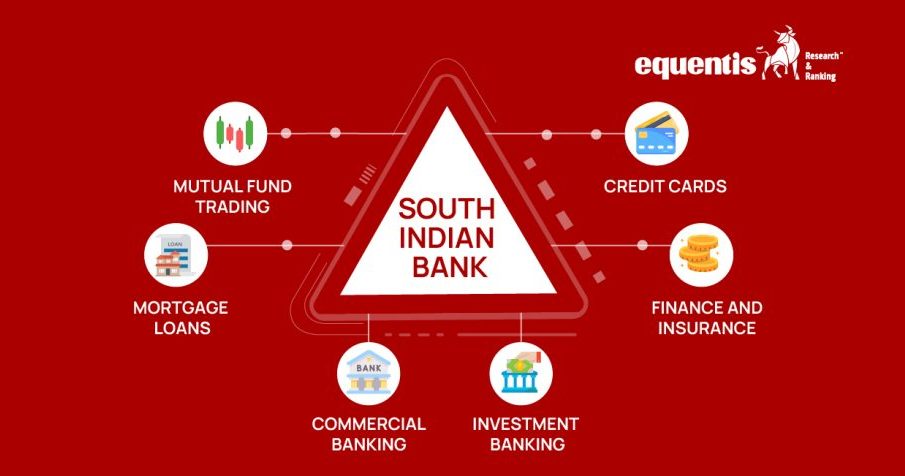

The share price of financial institutions like South Indian Bank plays a pivotal role in the investment decisions of traders and investors alike. It reflects the overall health of the bank and the banking sector at large. As of recent analyses, fluctuations in the share price can indicate market trends, investor sentiment, and potential future performance.

Recent Developments

As of mid-October 2023, the South Indian Bank share price has witnessed significant movements responding to a volatility in broader market trends. In the past month, the price has fluctuated between ₹17.50 and ₹19.50, with a notable rise in trading volume. Analysts attribute this increase to robust quarterly financial results released by the bank, showing improved asset quality and a rise in net interest income.

Market Analysis

Market analysts have pointed out the impact of external factors such as interest rate fluctuations and economic policies governing the banking sector. The recent announcements by the Reserve Bank of India regarding interest rates have had a ripple effect on many banks, including South Indian Bank. This has created both opportunities and challenges for investors. Despite these challenges, many analysts remain optimistic, projecting that share prices could cross the ₹20 mark as the bank continues to strengthen its operational efficiencies.

Investment Considerations

Investors looking into South Indian Bank should consider both the technical analysis and fundamental metrics. Metrics like Price-to-Earnings (P/E) ratio, return on equity (ROE), and asset quality will provide deeper insights into the bank’s profitability and risk factors. Furthermore, following expert opinions and quarterly forecasts will be crucial for making informed investment decisions.

Conclusion

In conclusion, the South Indian Bank share price is an indicator of not just the bank’s health but the overall sentiment in the banking sector in India. With recent performance improvements and a positive market outlook, the share price is expected to ride the current bullish sentiment, making it a topic of interest for investors in coming months. As always, thorough research and analysis will be key in navigating this investment avenue successfully.