Current Trends in Jindal Saw Share Price

Introduction

Jindal Saw Ltd., one of India’s leading manufacturers of steel pipes and tubes, has recently captured attention in the stock market due to notable fluctuations in its share price. As the construction and energy sector grows rapidly, understanding the factors influencing Jindal Saw’s share price is vital for investors and stakeholders alike.

Recent Performance

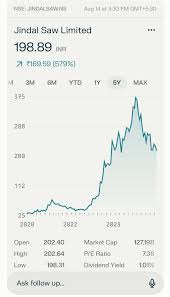

The Jindal Saw share price has been on a volatile path over the past month, currently trading at around ₹110 per share. Analysts attribute this fluctuation to a variety of factors including changing demand from the oil and gas sector, government infrastructure projects, and raw material price variations. The stock reached a peak of ₹125 earlier in the month, signaling optimism among investors regarding the company’s robust order book and expansion plans.

Market Influences

This year, Jindal Saw has reported a double-digit growth in revenue, thanks in part to a surge in domestic demand for pipes in infrastructure projects. However, the ongoing global supply chain issues and rising material costs have posed challenges. Additionally, international market trends have affected the stock’s performance, particularly movements in the prices of steel and iron ore.

Investor Interest

Institutional investors have shown increased interest in Jindal Saw, with several mutual fund houses boosting their stakes as reported in the latest quarterly filings. This indicates a level of confidence in the company’s performance despite the backdrop of economic uncertainty. Additionally, the recent announcements of strategic collaborations and expansions within the company have further fueled investor sentiments.

Conclusion

The outlook on Jindal Saw’s share price remains cautiously optimistic. While the company faces challenges due to economic headwinds and international developments, its solid fundamentals and increasing demand in key sectors provide a compelling narrative for long-term investors. As the market continues to evolve, monitoring Jindal Saw’s performance will be critical for stakeholders, particularly as it navigates through fluctuating prices and competitive pressures.