Analysis of Axis Bank Share Price Trends in 2023

Importance of Tracking Axis Bank Share Price

In today’s dynamic financial environment, understanding the movements of Axis Bank’s share price is crucial for investors. As one of India’s leading private sector banks, its stock performance provides valuable insights into the banking sector’s health and the broader economy.

Current Market Trends

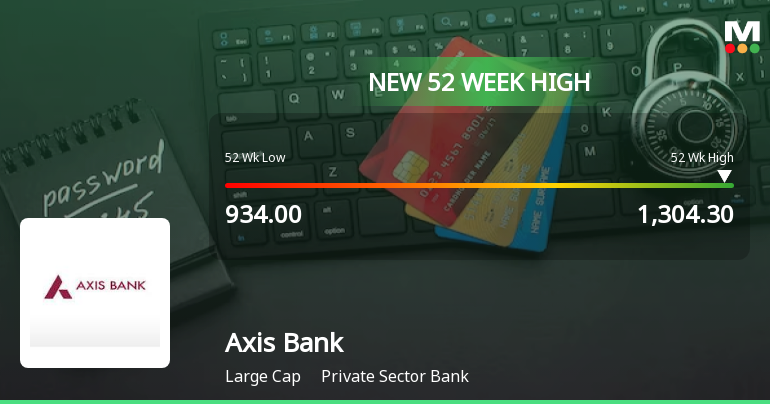

As of October 2023, the share price of Axis Bank has been witnessing significant fluctuations. Recent reports indicate that the stock has experienced an upward trend, buoyed by positive quarterly earnings and a robust growth forecast. Analysts highlight a current share price hovering around ₹950, which marks a substantial increase from its earlier price in the year.

Factors Influencing Share Price

The increase in Axis Bank’s share price can be attributed to various factors. First, the bank reported a year-on-year growth in net profit, attributed to lower provisioning for bad loans and increased net interest income. Additionally, the government’s focus on improving the banking sector’s robustness has provided a favorable environment for growth.

Investor Sentiment and Predictions

Investor sentiment towards Axis Bank remains optimistic. Financial analysts suggest that as long as the bank maintains its growth trajectory and manages asset quality effectively, the share price may continue its upward climb. Predictions for the upcoming quarter suggest potential resistance at ₹980, with further growth expected if macroeconomic conditions remain stable.

Conclusion

In conclusion, monitoring the Axis Bank share price is essential for investors seeking to make informed decisions. The current upward trend, backed by solid financial performance, indicates a potentially lucrative opportunity for stakeholders. Moving forward, keeping an eye on financial health indicators and broader economic policies will be key to understanding Axis Bank’s future share price movements.