Current Trends in Bank of Maharashtra Share Price

Introduction

Bank of Maharashtra is a prominent public sector bank in India, offering a range of financial services to its customers. The performance of its share price is crucial not just for investors but also for understanding the overall health of the banking sector in India. As of late 2023, fluctuations in share prices are heavily influenced by various economic indicators, market conditions, and corporate disclosures. This article delves into the current trends of the Bank of Maharashtra’s share price, its significance, and what investors can expect moving forward.

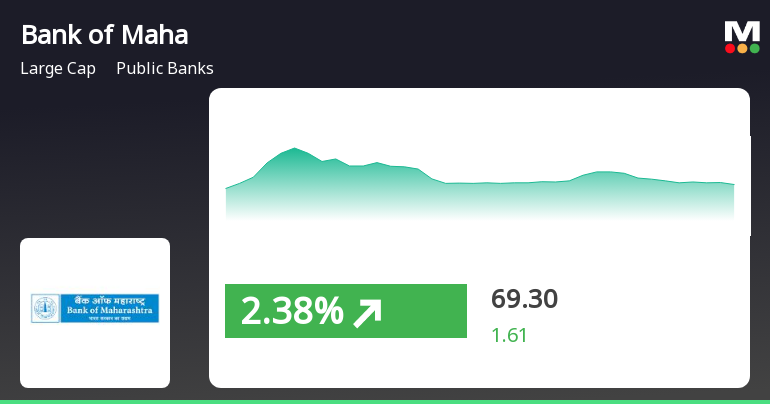

Current Share Price Performance

As of October 2023, the share price of Bank of Maharashtra is trading around INR 30-35. Over the past month, shares have seen a moderate increase of approximately 5% after highlighting robust quarterly results. The bank announced a significant rise in net profit, attributed mainly to a decline in bad loans and an increase in retail lending. This positive performance has caught the attention of both institutional and retail investors, potentially leading to increased market confidence.

Factors Influencing Share Price

Several factors are influencing the share price of Bank of Maharashtra. Firstly, the Reserve Bank of India’s monetary policy plays a critical role in shaping the bank’s operational framework and profitability. Recent policy decisions have aimed at improving liquidity in the banking sector. Moreover, the bank’s focus on digital banking and increasing customer base through innovative services is expected to strengthen its financial standing further.

Additionally, the government’s push for infrastructure and development funding is likely to lead to greater lending opportunities for the bank. This can enhance profitability, thereby positively impacting the share price.

Market Trends and Predictions

Analysts have varied forecasts regarding the future trajectory of Bank of Maharashtra’s share price. While some experts predict a steady rise due to favorable macroeconomic conditions and improved performance metrics, others urge caution, citing potential risks such as inflation and global economic uncertainties.

Conclusion

The Bank of Maharashtra’s share price remains a topic of interest as investors look for opportunities within the banking sector. The recent performance coupled with favorable government policies could position the bank for growth. However, investors should stay informed and consider both the opportunities and risks that come with investing in this public sector bank. For those looking to invest, keeping a close eye on quarterly results and economic indicators will be vital in making informed decisions.