Recent Trends in Paytm Share Price: An Overview

Introduction

Paytm, one of India’s leading fintech companies, has been a topic of significant interest among investors and market analysts. The share price of Paytm is essential not only for its investors but also for the broader Indian stock market, reflecting the company’s financial health and growth potential.

Current Share Price Movement

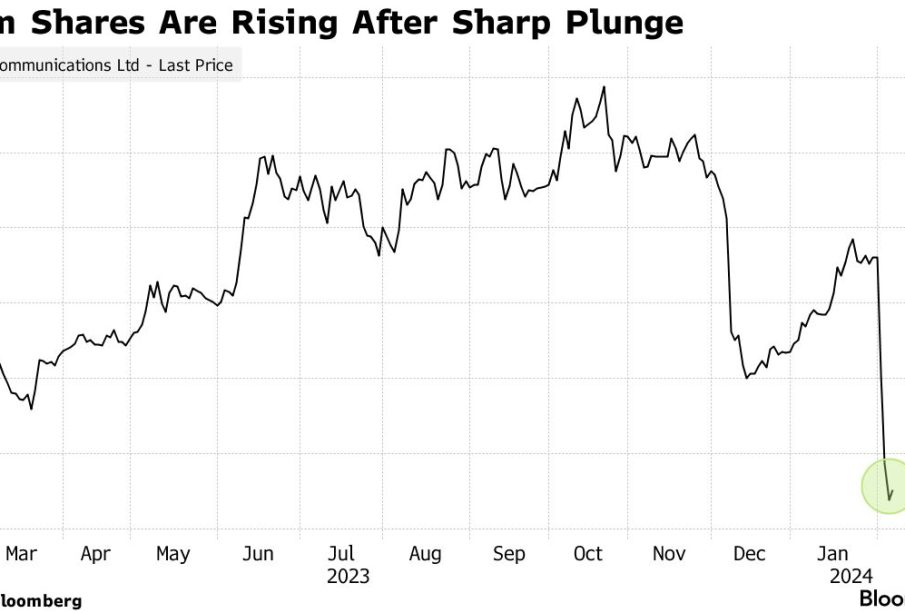

As of October 2023, the share price of Paytm (One97 Communications Ltd) has seen notable fluctuations. After a challenging start when it was listed in November 2021, the stock initially struggled, dropping below its issue price. However, recent quarterly earnings reports, which showcased improvements in revenue and user engagement, have positively impacted the share price, leading to a recovery trend.

On October 15, 2023, Paytm’s stock closed at ₹600, reflecting a 5% increase from the previous week. Analysts attribute this rise to the company’s strategic initiatives aimed at expanding its user base and enhancing its product offerings. The digital payments sector in India is rapidly growing, and Paytm’s position as a market leader has been a crucial factor in its share price resurgence.

Factors Influencing Paytm’s Share Price

Several factors play a critical role in determining Paytm’s share price:

- Financial Performance: Continuous revenue growth and profitability are vital for investor confidence.

- Market Competition: As competitors emerge, maintaining market leadership will be essential.

- Regulatory Changes: Policies affecting digital payments can impact operational capabilities.

- Investor Sentiment: Market trends and investor perceptions significantly affect stock valuations.

Conclusion

Monitoring the Paytm share price is crucial for existing and potential investors as it can indicate trends within the fintech sector and the Indian economy. Analysts forecast a cautiously optimistic outlook, suggesting that if Paytm continues to innovate and adapt to market demands, its share price could stabilize and even rise over time. As the company navigates the competitive landscape, staying informed about its financial health and market strategies will be imperative for making informed investment decisions.