Current Trends in Union Bank Share Price

Introduction

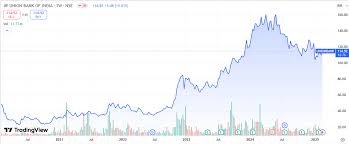

The share price of Union Bank of India has been a significant topic among investors and financial analysts, particularly as the financial sector continues to witness fluctuations due to economic factors. Tracking the share price of Union Bank is vital for investors looking to gauge the bank’s performance and viability in the competitive landscape of Indian banking.

Current Share Price Overview

As of October 2023, Union Bank’s share price has shown varied dynamics. Recent reports indicate that the share price has seen a minor increase over the past month, attributed to the bank’s robust quarterly performance, where it reported a significant rise in net profit due to improved asset quality and a decrease in non-performing assets.

Currently, the share is trading at INR 70, reflecting a 2% increase from the previous week. The company’s strong fundamentals instill a sense of confidence among investors, especially amid expectations of favorable monetary policy outcomes in the upcoming Reserve Bank of India meetings.

Factors Influencing Share Price

Several factors influence the fluctuation of Union Bank’s share prices, such as economic reforms, interest rate changes, and the stability of the banking sector. Additionally, the bank’s various initiatives and strategic collaborations have improved its operational efficacy, further encouraging positive investor sentiment. The bank has focused on digitization and enhancing customer services, which is contributing to its growth prospects.

Market Analyst Views

Market analysts remain optimistic regarding Union Bank’s share price trajectory. According to a recent report by ICICI Securities, they suggest buying the stock at the current price, predicting a potential upside to INR 85 within the next six months. Financial experts argue that the increasing focus on asset recovery and risk management will support the bank’s growth, likely having a positive impact on share price.

Conclusion

In conclusion, Union Bank’s share price remains a focal point for investors in the banking sector, offering potential growth amid a recovering economic landscape. As the bank continues to show improvements in its performance metrics, the outlook appears positive. Investors should stay informed on market trends, potential economic changes, and the banking sector’s status to better understand the implications for Union Bank’s share price in the near future.