Current Status of DMart Share Price in the Market

Introduction

The share price of DMart, one of India’s leading retail supermarket chains, has been a significant topic of interest for investors and market analysts alike. As of October 2023, understanding the current performance of DMart shares is essential for market participants, considering the company’s recent financial outlook and growth strategies.

Current Market Trends

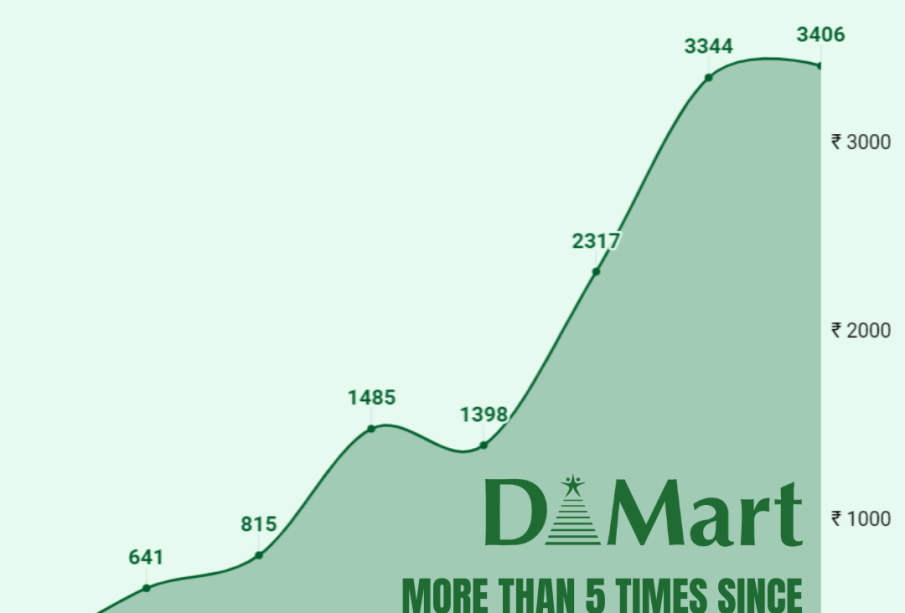

As reported on October 20, 2023, DMart’s share price has shown a steady increase, trading at approximately ₹3,205. This marks a year-to-date rise of around 15%, influenced by the company’s robust quarterly earnings report that exceeded market expectations. The firm reported a net profit of ₹536 crores for the second quarter of the fiscal year 2023-24, compared to ₹456 crores in the same quarter last year, showcasing a significant growth trajectory.

Factors Influencing Share Price

Several factors have contributed to the recent uptick in DMart’s share price. Firstly, increased footfall in stores post-pandemic has rekindled strong sales figures. Additionally, DMart’s strategic expansion plans into tier-2 and tier-3 cities have fueled positive investor sentiment. The management’s commitment to maintaining a competitive pricing strategy has also resonated well with budget-conscious consumers, contributing to sustained revenue growth.

Furthermore, global retail trends and the resilience shown by DMart through economic fluctuations make it an attractive option for long-term investors. However, analysts do warn that fluctuating raw material costs and competition from online grocery platforms could pose challenges ahead.

Outlook and Significance for Investors

Looking ahead, analysts remain optimistic about DMart’s potential in the retail sector. With its strong business model and financial performance, DMart continues to be a favored choice among retail investors. Predictions suggest that if the current growth momentum continues, the share price could reach new heights by the end of the fiscal year, especially if seasonal sales trends pick up.

In conclusion, while DMart’s share price has seen positive growth recently, potential investors should continuously monitor market conditions and company performance. As retail remains a dynamic sector, the adaptability and strategic initiatives by DMart will play a crucial role in shaping its stock performance going forward.