ICICI Bank Share Price: Market Trends and Insights

Introduction

The share price of ICICI Bank, one of India’s leading private sector banks, is a significant indicator for investors and analysts alike. As of October 2023, the bank’s performance in the stock market continues to attract attention, particularly amongst retail and institutional investors. Understanding the fluctuations in ICICI Bank’s share price is essential for making informed investment decisions.

Current Price Trends

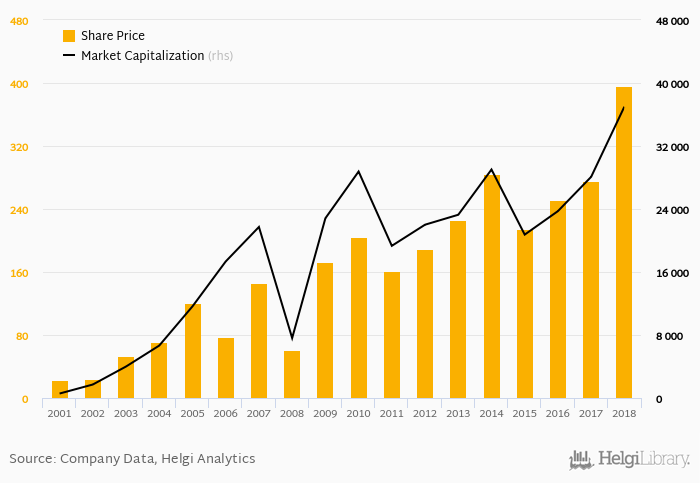

As of October 25, 2023, the ICICI Bank share price is reported to be approximately ₹1,000, having witnessed a steady growth of around 15% over the past six months. The bank has seen a positive response in the market due to strong quarterly earnings reports, which revealed an increase in net profit by 20% year-on-year. Analysts have attributed this growth to a reduction in bad loans and a robust retail banking segment.

Market Influences

Several factors have influenced the recent performance of ICICI Bank’s share price. The overall bullish trend in the banking sector, driven by increased lending and improved asset quality, has undoubtedly played a role. Moreover, macroeconomic factors such as a stable interest rate environment and improved consumer confidence have positively impacted the bank’s financial health.

Additionally, the RBI’s decision to maintain key interest rates has provided a conducive environment for banks to lend more, which directly translates into increased revenues for ICICI Bank. Analysts recommend keeping an eye on upcoming financial policies as they may further affect the banking sector’s dynamics.

Future Outlook

Looking ahead, market analysts remain optimistic about ICICI Bank’s growth trajectory. Predictions suggest that the share price could see an upward trend in the coming months, particularly if the bank continues to report strong earnings and manage its non-performing assets effectively. Some estimates project a potential target range of ₹1,100-₹1,200 within the next financial quarter, depending on economic conditions and market responses.

Conclusion

The ICICI Bank share price remains a crucial aspect of investor interest as it reflects the bank’s financial health and market position. With ongoing positive trends and robust growth metrics, it is anticipated that investors will continue to keep a close watch on its performance. For those considering investment in the banking sector, ICICI Bank’s share price could be a viable option. However, potential investors are advised to conduct thorough research and possibly consult financial experts before making any investment decisions.