Latest Trends in Reliance Share Prices

Introduction

Reliance Industries Limited (RIL) is one of India’s largest conglomerates with diverse interests ranging from petrochemicals to telecommunications. Due to its substantial impact on the economy, fluctuations in Reliance share prices attract significant attention from investors and analysts alike. Understanding the current trends and factors influencing these shares is crucial for both seasoned investors and newcomers in the stock market.

Current Share Price Trends

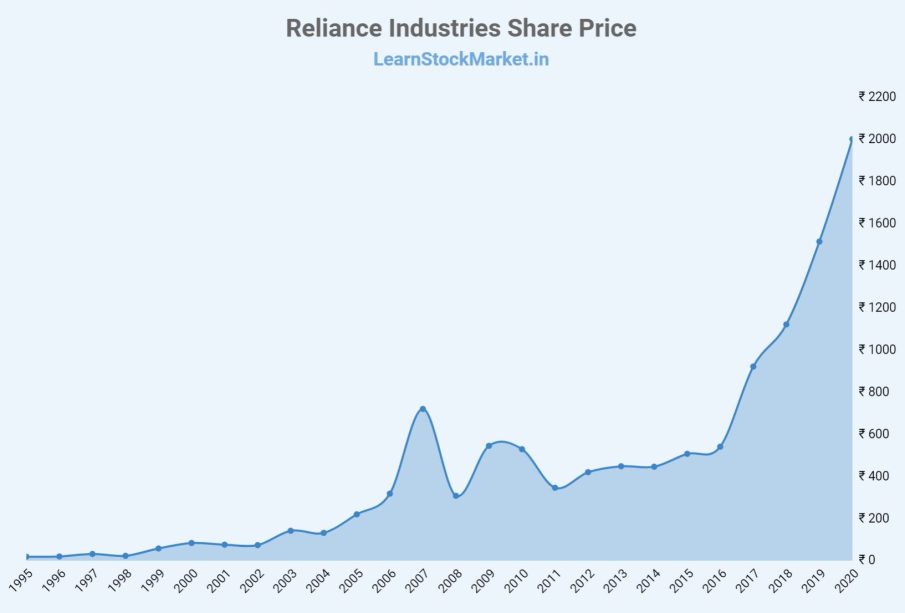

As of February 2023, Reliance shares have witnessed a notable increase, currently trading around ₹2,600 per share, following a steady upward trend over the past few months. This growth can be attributed to better-than-expected quarterly results, with RIL reporting a 20% increase in net profit, bolstered by strong performance in its telecom and retail sectors. Investors are optimistic, driven by the company’s robust growth strategy and expansion in renewable energy.

Key Drivers Affecting Reliance Shares

Several factors influence Reliance share prices:

- Telecom Expansion: With Reliance Jio’s sustained growth in subscriber numbers and increasing average revenue per user (ARPU), the telecom segment remains a vital revenue driver.

- Retail Sector Growth: Reliance Retail has been expanding aggressively, leading to significant revenue contributions and prospects of sustained growth.

- Renewable Energy Ventures: RIL’s commitment to investing in renewable energy aligns with global sustainability trends, attracting investor interest.

- Market Sentiment: Global economic factors and investor sentiment also play a crucial role in shaping Reliance’s market performance.

Recent Developments

In recent weeks, RIL announced collaborations with international firms to advance its green energy initiatives. Additionally, its foray into digital services continues to gain traction, with several new product launches expected soon. Analysts forecast that these initiatives could significantly impact the company’s market capitalization and share price stability in the long run.

Conclusion

As Reliance continues to diversify and innovate, the share prices are likely to remain attractive for investors. The current upward trend reflects a positive outlook, although potential investors should remain conscious of market fluctuations and global economic conditions. Staying informed about company announcements, industry trends, and economic indicators is essential for making informed investment decisions regarding Reliance shares.