Current Trends in Godfrey Phillips Share Price

Introduction

Godfrey Phillips India Limited, a prominent player in the tobacco sector, holds significance for investors and market analysts. The company’s share price is a reflection of its operational performance, market conditions, and investor sentiment. Understanding its current trends is crucial for stakeholders aiming to make informed decisions in the volatile stock market of 2023.

Recent Share Price Trends

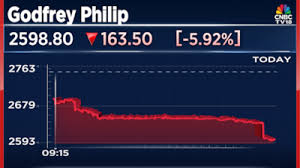

As of October 2023, Godfrey Phillips’ share price has been experiencing fluctuations, influenced by various factors such as regulatory changes, market demand for tobacco products, and overall economic conditions. The stock opened the month at ₹1,050, showing a subtle upward trend as the company reported a Q2 profit growth of 10% year-on-year, driven by increased sales in both domestic and export markets.

However, the share price witnessed a decrease mid-month, closing at ₹1,012 after speculations arose regarding stricter regulations on tobacco advertising and consumption. Investors reacted cautiously to these developments, leading to a temporary dip in share value.

Market Analysis

Analysts suggest that Godfrey Phillips’ share price will continue to be affected by several external forces. The ongoing discussions around the implementation of stricter taxation on tobacco products and the increasing health awareness among consumers could create further pressure on share prices in the future. On the positive side, the company’s diversification efforts into non-tobacco products may help stabilize revenue streams.

Despite the challenges, many analysts maintain a ‘buy’ rating on Godfrey Phillips stocks, citing its strong brand equity and robust distribution network as key strengths that can sustain profitable growth in the long run. Additionally, the company’s commitment to sustainability and corporate social responsibility could enhance its reputation and appeal among socially conscious investors.

Conclusion

In conclusion, the Godfrey Phillips share price is reflective of a complex interplay of market dynamics, regulatory frameworks, and consumer behaviour. Looking ahead, investors should closely monitor regulatory news and market trends affecting the tobacco industry. While current fluctuations pose challenges, the long-term outlook remains cautiously optimistic, subject to the company’s strategic responses to external pressures. Staying informed on these developments will be critical for stakeholders looking to navigate the landscape of Godfrey Phillips shares in the coming months.