Latest Trends in Dixon Technologies Share Price

Introduction

Dixon Technologies (India) Ltd., a leading player in the electronics manufacturing sector, has gained significant attention from investors recently due to its impressive growth trajectory and expansion plans. Understanding the share price movements of Dixon Technologies is vital for both current and potential investors, as it reflects the company’s performance and sentiments within the market.

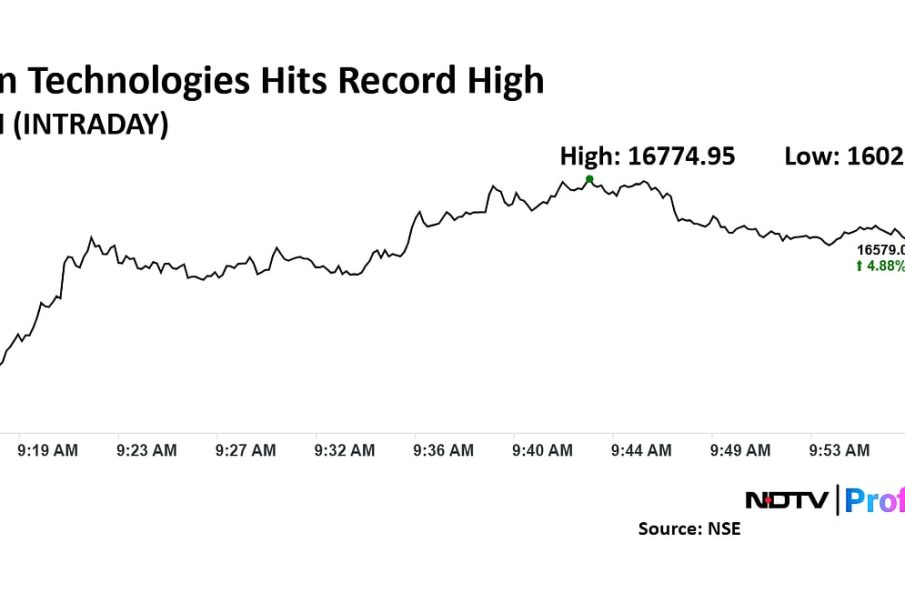

Current Trends in Share Price

As of the latest trading session, Dixon Technologies’ share price stands at ₹4,200, reflecting a rise of approximately 3% from the previous close. The stock has experienced volatility over the past month, attributed to broader market trends and specific company developments, including the recent announcement of new contracts with major international clients.

Market Influences

The electronics industry is currently on the rise, fueled by increasing domestic and export demands. Dixon Technologies has been strategically positioning itself to capitalize on this surge. The company reported a strong quarterly performance with a year-on-year revenue growth of 25%, further boosting investor confidence. Analyst forecasts suggest that if Dixon continues on this path, the share price could see a bullish trend in the coming months.

Investor Sentiment

Investor sentiment around Dixon Technologies remains positive. Following announcements of partnerships with global brands and expansion into new product segments, analysts believe that the stock holds significant upside potential. Investment firms have upgraded their ratings on the stock, advising clients to consider long-term holds given the company’s fundamentals.

Conclusion

In conclusion, Dixon Technologies’ share price reflects not only the company’s impressive growth but also the overall health of the electronics manufacturing industry in India. For investors, monitoring Dixon’s stock movements and the factors influencing its price will be crucial for making informed decisions. Analysts recommend keeping an eye on upcoming earnings reports and industry trends, as they will be significant indicators of the company’s future performance and share price trajectory.