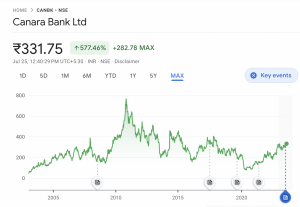

Analyzing Canara Bank Share Price: Trends and Insights

Introduction

Canara Bank, one of India’s leading public sector banks, has been a pivotal player in the Indian banking sector. With the recent fluctuations in stock markets, the share price of Canara Bank has garnered significant attention from investors and market analysts alike. Understanding the factors that influence its share price is essential for potential investors and stakeholders aiming to make informed decisions.

Current Share Price and Market Performance

As of the latest trading session, Canara Bank’s share price was reported at ₹307.50, reflecting a moderate increase of approximately 1.5% from the previous day’s close. This uptick comes amid positive sentiment towards banking stocks, driven by robust quarterly earnings reports and a favorable economic outlook. Over the past month, the bank’s shares have seen a growth rate of about 8%, indicating a steady recovery post the pandemic-induced market slump.

Factors Influencing Share Price

Several factors contribute to the fluctuations in Canara Bank’s share price. Primarily, the bank’s performance in terms of asset quality, loan growth, and profitability plays a crucial role. The bank recently reported a net profit increase of 30% in the last quarter, driven by lower provisioning for bad loans and strong retail credit growth. Such performances tend to enhance investor confidence and positively influence the share price.

Additionally, macroeconomic factors, including interest rates, inflation, and regulatory policies imposed by the Reserve Bank of India (RBI), have a significant impact on banking sector stocks. The recent decision by the RBI to maintain a steady interest rate has further bolstered expectations for loan demand, boosting the bank’s outlook.

Market Outlook and Predictions

Financial analysts predict that Canara Bank’s shares might continue on a positive trajectory in the coming months, influenced by the government’s focus on improving credit access and economic recovery post-COVID-19. Analysts suggest a target price range of ₹330-₹350 for Canara Bank shares by the end of the fiscal year, provided that the bank maintains its growth momentum and prudent management of its assets.

Conclusion

For investors interested in the banking sector, keeping an eye on Canara Bank’s share price trends is essential. The bank’s solid performance and growth prospects present significant opportunities, especially as the Indian economy continues to rebound. As with any investment, potential investors should conduct thorough research and consider market conditions before making investment decisions.