Current Trends in Groww Share Price Analysis

Introduction

Groww, a prominent Indian investment platform, has been making waves in the financial markets since its inception. Founded in 2016, it quickly became one of the go-to apps for mutual funds and stock trading among young investors. The recent buzz surrounding the company includes the anticipation and subsequent fluctuations in its share price following its IPO and subsequent market performance. Understanding the current trends in Groww’s share price is not only crucial for potential investors but also for those interested in the broader trends in the fintech sector.

Current Share Price Trends

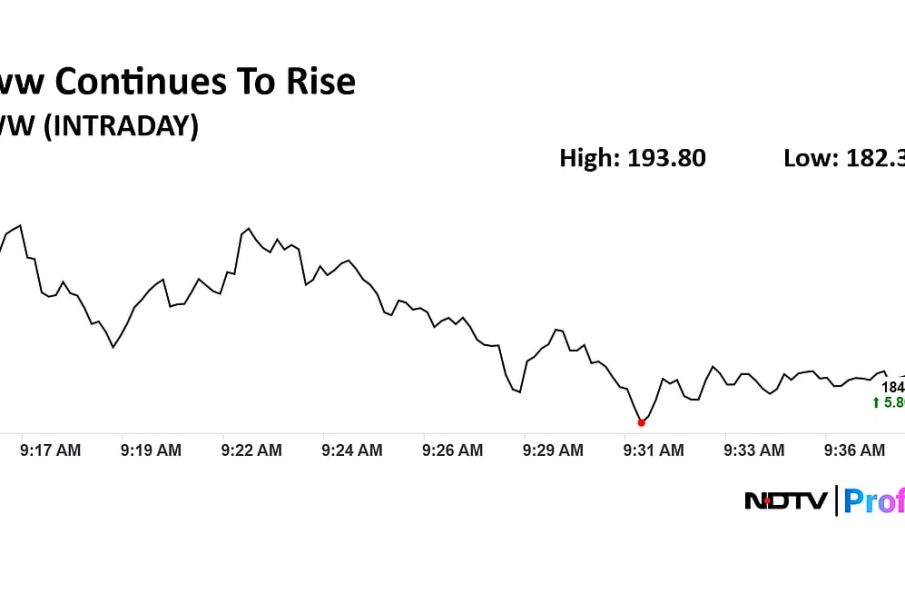

As of mid-October 2023, Groww’s shares are experiencing notable volatility, primarily influenced by market sentiments and economic indicators. The company has seen its share price rise by approximately 15% since its debut on the stock exchange, reflecting strong investor interest. Analysts attribute this to several factors, including the growing adoption of digital investment platforms and the increasing number of registered users on the app, which has surpassed 100 million.

Factors Influencing Growth

Several key factors are driving the growth in Groww’s share price:

- Market Expansion: Groww has expanded its services beyond mutual funds to include stocks, fixed deposits, and even cryptocurrency trading.

- User Engagement: With user engagement at an all-time high, the company has introduced multiple features, including educational resources aimed at empowering novice investors.

- Market Recovery: The Indian stock market has shown signs of recovery post-pandemic, positively impacting investor confidence across the tech and finance sectors.

Predictions and Future Outlook

Looking forward, analysts predict that Groww’s share price could continue to rise, given the increasing shift towards digital financial solutions and the expansion potential in rural areas. However, geopolitical factors and changes in regulatory frameworks could pose risks. Experts recommend that potential investors conduct thorough research and consider both the current market conditions and Groww’s performance metrics before making investment decisions.

Conclusion

The Groww share price encapsulates the dynamism of the fintech industry in India and reflects broader economic trends. For investors, staying updated with the latest market analysis and financial news is essential in capitalizing on opportunities that arise from such fluctuations. As Groww continues to innovate and expand its platform, its share price will likely serve as a crucial indicator of its market standing and growth trajectory.