Latest Updates on IRCON Share Price

Introduction

IRCON International Limited, a public sector enterprise, plays a prominent role in the infrastructure sector in India. Listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), IRCON’s share price is closely monitored by investors and analysts due to its impact on various infrastructure projects and government initiatives. Understanding its share price trends is vital for stakeholders in making informed investment decisions.

Current Share Price Analysis

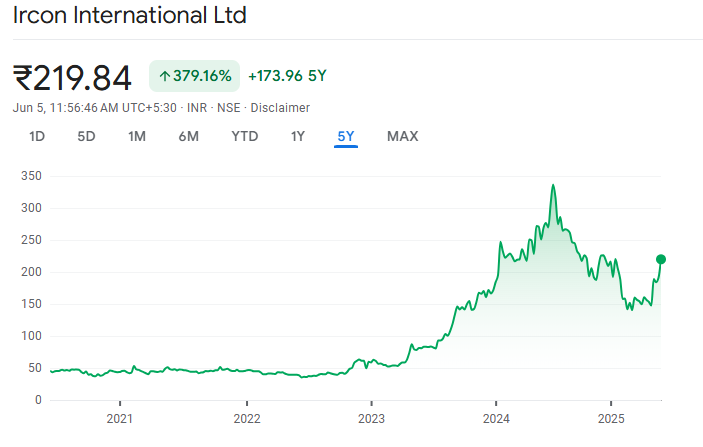

As of October 2023, IRCON’s share price has witnessed fluctuations that are reflective of broader market trends and specific company performance. The stock is currently trading at approximately INR 60 per share, a moderate increase from its levels seen earlier this year. This uptick in share price is attributed to the company’s recent announcements regarding new project approvals and strong quarterly earnings results.

Factors Influencing Share Price

Several factors influence IRCON’s share price. Firstly, government investments in infrastructure, such as roads, railways, and urban transit systems, directly impact the company’s revenue and profitability. Recent reports show that the Indian government has allocated substantial budgetary funds for infrastructure development, which bodes well for IRCON.

Secondly, IRCON’s expansion into international markets has garnered attention. Projects in neighboring countries have diversified its revenue streams, mitigating risks associated with domestic market volatility. Additionally, the global supply chain issues and changes in material costs can affect project timelines and profit margins, thereby influencing investor sentiment and share price.

Market Sentiment and Future Outlook

Market analysts remain optimistic about IRCON’s future prospects. According to a recent report by investment analysts, the company is expected to maintain steady growth, fueled by ongoing government projects and international contracts. With the current focus on enhancing infrastructure, share price forecasts suggest potential targets between INR 65 to INR 75 in the coming months, assuming stable market conditions.

Furthermore, IRCON’s commitment to sustainability and innovation in project execution could attract conscientious investors and drive long-term profits.

Conclusion

In conclusion, keeping an eye on IRCON’s share price is essential for investors looking to capitalize on infrastructure growth trends in India. As the company continues to embark on new projects and navigate market challenges, the outlook remains optimistic. Investors are advised to stay updated with quarterly reports and market news to make well-informed decisions.