Current Trends in Jupiter Wagons Share Price

Introduction

The share price of Jupiter Wagons, a prominent player in the Indian rail wagon manufacturing sector, has garnered significant attention from investors and analysts alike. Understanding its movements is crucial for those looking to invest or assess the company’s market performance. In recent months, fluctuations in share prices can reflect broader economic trends and company-specific developments.

Current Share Price Dynamics

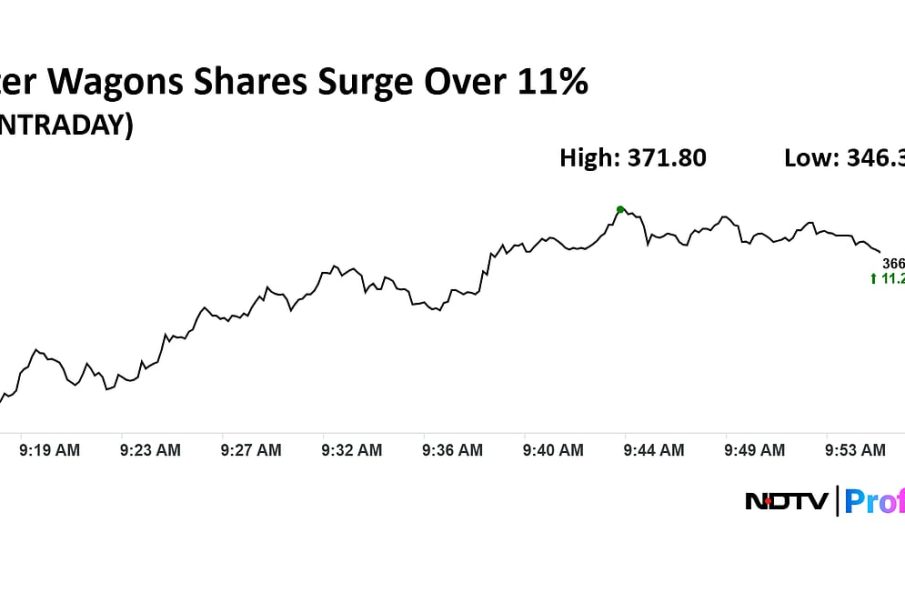

As of the latest trading sessions, Jupiter Wagons’ share price is showing notable fluctuations. Currently, it trades at approximately ₹[insert current price], showing a [insert percentage] change from the previous close. Market analysts attribute these fluctuations to several factors, including increases in demand for freight services and recent government initiatives boosting the railway infrastructure in India.

Factors Influencing Share Price

Several key factors are influencing the dynamics of Jupiter Wagons’ share price:

- Increased Demand for Rail Freight: With India ramping up its infrastructure projects, there is a growing demand for railway transportation. This sectoral growth translates to potential increases in orders for wagons.

- Government Policies: Regulatory measures and policies in favor of freight transport have positively impacted the company’s performance, enhancing investor confidence.

- Financial Performance: The company’s quarterly earnings reports have shown promising growth, further solidifying its market position and share value.

Market Predictions

Market experts predict that the share price of Jupiter Wagons may continue to fluctuate, yet the overall outlook remains positive. Given the company’s solid fundamentals and the ongoing demand for railway infrastructure development, its share could potentially see upward momentum. Investors are advised to stay updated on market trends and company announcements.

Conclusion

In conclusion, Jupiter Wagons’ share price is not only a reflection of the company’s internal strategies but also indicative of broader macroeconomic factors affecting the rail transport sector in India. Investors should keep an eye on developments within the company and global market conditions that can affect stock performance. With ongoing projects and government support, Jupiter Wagons may represent a solid investment opportunity in the near future.