Latest Updates on KSH International IPO GMP Today

Introduction

The KSH International IPO has garnered considerable attention from investors looking for opportunities in the burgeoning stock market. The GMP (Gray Market Premium) of an IPO is a critical indicator of its market performance and investor sentiment. As KSH International gears up for its IPO launch, understanding its GMP today provides insights into its potential reception in the market.

Current GMP of KSH International

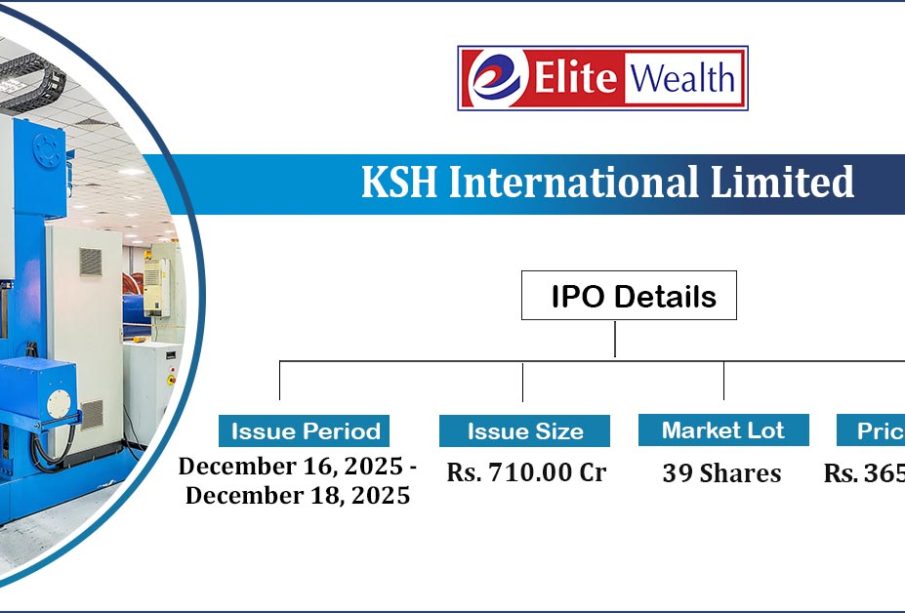

As of today, the GMP for KSH International stands at ₹50, reflecting a positive sentiment among investors. This premium highlights the robust demand projected for the shares and suggests that investors are optimistic about the company’s growth potential and financial health. The company aims to raise approximately ₹500 crores through this IPO, offering 1 crore equity shares to the public.

Factors Influencing the GMP

Several factors contribute to the current GMP of KSH International. The company, which operates in the technology sector, has demonstrated significant growth over the past few years, showcasing a 25% increase in revenue year-on-year. Additionally, recent market trends indicate a rising interest in technology-driven companies, which further bolsters investor confidence. Analysts believe that the company’s innovative solutions and strong market position make it an attractive investment opportunity.

Market Response and Predictions

Investor response has been overwhelmingly positive, with early indications showing strong demand for the shares. The upcoming IPO is expected to open doors for KSH International, potentially leading to a higher stock price post-listing. Market experts predict that if the GMP remains steady or increases, the IPO may witness full subscription across all categories.

Conclusion

The KSH International IPO GMP today is a crucial indicator for prospective investors. With a current GMP of ₹50, the market sentiment appears favorable, and if the trend continues, it could signify a successful IPO launch. Investors are advised to closely monitor the developments as the IPO date approaches, as it will influence both the offering and future market trajectory of the company. With anticipation building, KSH International’s IPO presents a noteworthy opportunity in the current market landscape.