Overview of HCC Share Price Trends and Market Analysis

Introduction

The HCC share price is a critical metric for investors tracking the performance of Hindustan Construction Company (HCC), a major player in the Indian infrastructure sector. With ongoing projects and evolving market dynamics, understanding HCC’s share price trends is essential for potential investors and industry analysts alike.

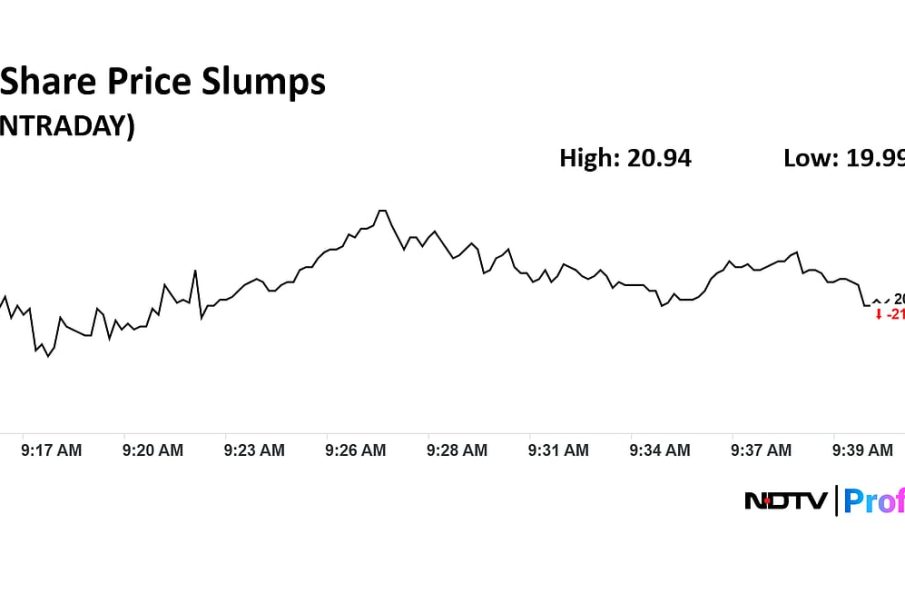

Current Market Status

As of October 2023, HCC’s shares have shown considerable volatility, reflecting broader market trends and specific company news. Currently, the share price hovers around INR 45, influenced by the ongoing recovery in the construction sector, coupled with recent government initiatives aimed at boosting infrastructure spending in India. In the past month, shares have fluctuated between INR 40 and INR 50, presenting both challenges and opportunities for investors.

Factors Impacting Share Price

Several factors have impacted the HCC share price recently:

- Government Policies: Initiatives such as the National Infrastructure Pipeline have positively affected investor sentiments towards construction stocks.

- Project Wins: HCC’s recent announcements regarding securing new contracts, including prestigious metro rail projects, have boosted investor confidence.

- Market Competition: Competition from other infrastructure companies has also led to pressures on pricing and project bids, impacting profit margins.

Investor Outlook

Analysts remain cautiously optimistic about HCC’s future. While the share price may experience short-term fluctuations, the long-term outlook is generally positive, contingent upon effective execution of projects and management’s ability to navigate challenges. HCC’s strategic initiatives, such as diversifying its project portfolio and enhancing operational efficiencies, are expected to drive growth in the coming years.

Conclusion

The HCC share price is pivotal for investors keen on capitalizing on India’s burgeoning infrastructure market. As government policies continue to favor construction and infrastructure development, HCC stands to benefit. Investors are advised to stay abreast of market changes and company performance indicators to make informed decisions. Monitoring trends in the HCC share price will be crucial for assessing its investment potential.