Current Analysis of Bajaj Housing Finance Share Price

Introduction

Bajaj Housing Finance Limited has emerged as a key player in the Indian housing finance sector. Understanding the dynamics of its share price is essential for investors and market analysts alike, especially with the ongoing changes in the real estate market and interest rate fluctuations.

Recent Trends

As of October 2023, Bajaj Housing Finance shares have exhibited notable volatility, reflecting broader trends in the financial markets. Over the past month, the share price has fluctuated between ₹580 to ₹630, influenced by both internal company performance and external economic factors, including the Reserve Bank of India’s monetary policy decisions.

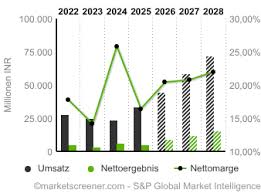

Market Performance

The shares have seen a positive uptick, with a year-to-date increase of approximately 15%, largely driven by a surge in demand for housing loans as interest rates remain stable. This growth trajectory has led analysts to predict further potential gains, contingent on the company’s quarterly results and broader economic conditions.

Factors Influencing Share Price

Several key factors contribute to the share price fluctuations:

- Interest Rates: With the RBI indicating a pause in rate hikes, home loan affordability is expected to drive demand, positively affecting share prices.

- Housing Market Dynamics: The real estate market’s recovery post-pandemic has fueled loan disbursements, enhancing investor confidence.

- Company Performance: Strong quarterly earnings reports and strengthening asset quality indicators have resulted in positive sentiment among investors.

Conclusion

In conclusion, Bajaj Housing Finance’s share price movements are reflective of significant trends within the housing finance sector and the overall economy. With encouraging signs in consumer demand and stable interest rates, analysts remain optimistic about future growth prospects. Investors should remain vigilant, monitor market trends, and consider the potential impacts of economic policy changes on share performance.