Understanding HCC Share Price: Trends and Insights

Introduction

The share price of Hindustan Construction Company (HCC) has become a focal point for many investors and analysts recently. As one of India’s leading infrastructure and construction firms, HCC’s performance on the stock market reflects broader trends in the construction sector, as well as the overall economic climate. Given India’s increasing focus on infrastructure development, understanding the fluctuations in HCC’s share price is essential for assessing investment opportunities.

Current Market Performance

As of October 2023, HCC’s share price has shown significant volatility. Currently trading around INR 38, the share price experienced a notable increase of 15% over the past month, reflecting growing investor confidence. This surge can largely be attributed to various government initiatives aimed at enhancing infrastructure and improving public spending. Additionally, HCC’s recent contract wins in major projects, including highway construction and urban transport systems, have bolstered its market position.

Factors Influencing HCC Share Price

Several key factors are influencing the current trends in HCC’s share price:

- Government Policies: The Indian government’s push for infrastructure spending has positively impacted construction companies like HCC, enabling them to secure lucrative contracts.

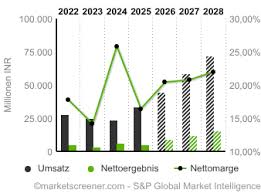

- Financial Performance: HCC reported a quarterly revenue increase of 20% year-on-year, which has been favorably received by the market.

- Market Sentiment: General bullish sentiment in the stock market, particularly in the infrastructure segment, is propelling HCC’s stock price higher.

Future Outlook

Looking ahead, the future of HCC’s share price is expected to remain optimistic, provided that the company continues to secure significant contracts and manage its operational costs effectively. Analysts predict that with ongoing government projects and private sector collaborations, HCC could see further growth. However, potential risks, such as fluctuations in raw material costs and competition from other construction firms, could impact share performance.

Conclusion

In conclusion, the HCC share price has witnessed encouraging trends influenced by various economic and financial factors. For investors considering positions in HCC, staying informed about market developments, government policies, and the company’s financial health will be crucial. As India’s infrastructure sector evolves, HCC’s performance on the stock exchange will likely serve as an indicative measure of the industry’s overall health.