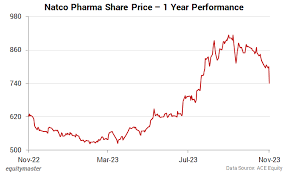

Current Trends in Natco Pharma Share Price

Introduction

Natco Pharma, a significant player in the Indian pharmaceuticals sector, has been in the spotlight due to its recent performance on the stock market. The share price of Natco Pharma is not only crucial for investors looking to trade in pharmaceutical stocks but also indicative of the company’s overall health and market strategies. Understanding the movements in its share price can provide insights into broader market trends and investor sentiment related to the pharma industry.

Current Share Price Overview

As of the latest trading session, the share price of Natco Pharma has seen significant fluctuations. Following a report released on October 1, 2023, which projected an optimistic revenue growth owing to new product launches, the stock surged by approximately 6% on the Bombay Stock Exchange (BSE), reaching Rs. 900 per share. Analysts suggest that the growth in share price can be attributed to the company’s successful entry into new markets and strategic partnerships established over the last quarter.

Factors Influencing Share Price

Several factors play a critical role in determining the share price of Natco Pharma:

- Market Dynamics: The pharmaceutical sector is highly competitive, and Natco Pharma’s ability to innovate and adapt to market needs significantly influences its stock performance.

- Regulatory Approvals: Timely approvals from the pharmaceuticals regulatory bodies can lead to a hike in share prices, especially when new drugs are involved.

- Financial Reports: Quarterly earnings reports have an immediate impact on share prices. Positive earnings as a result of increased sales and profitability have historically led to stock price increases.

- International Market Trends: With Natco Pharma expanding its reach internationally, changes in global market dynamics and policies can also affect its stock performance.

Investor Sentiment and Predictions

Investor sentiment around Natco Pharma remains positive, with many analysts recommending it as a buy. This is also reflected in the increased trading volumes and sustained interest from institutional investors. Forecasts indicate a bullish outlook for the share price, especially with anticipated product approvals in the near future. Analysts predict that if the company successfully launches its pipeline products, share prices could witness further upward momentum.

Conclusion

The fluctuations in Natco Pharma’s share price reflect the broader trends within the pharmaceutical sector, influenced by both internal and external factors. For investors, staying informed about market conditions, regulatory changes, and the company’s strategic initiatives is essential to capitalize on opportunities in the stock market. As Natco Pharma continues to innovate and expand, its share price is likely to remain a topic of keen interest for both current and potential investors.