Current Analysis of EaseMyTrip Share Performance

Introduction

EaseMyTrip, a prominent player in the Indian online travel booking industry, has become a topic of interest for investors and market analysts alike. The company’s share performance has gained significant attention, especially in the wake of the ongoing recovery in travel demand post-COVID-19 pandemic. Understanding the dynamics of EaseMyTrip shares is crucial for stakeholders looking to invest in this rapidly growing sector.

Recent Performance and Events

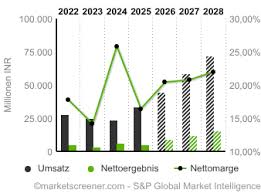

As of October 2023, EaseMyTrip shares have witnessed fluctuations in their market value, reflecting broader trends in the aviation and travel sectors. After a robust recovery in travel bookings, the company reported a strong quarterly performance with a notable increase in revenue by 40% compared to the previous year. This growth is attributed to the resurgence of travel, driven by a pent-up demand for leisure and business trips.

In a recent financial briefing, EaseMyTrip announced strategic plans for expansion and diversification, including the introduction of new services and partnerships aimed at enhancing customer experience. This forward-looking approach has influenced investor sentiment positively, contributing to a rise in share prices.

Investor Sentiments

Market analysts are closely watching EaseMyTrip’s share performance as it is seen as an indicator of the travel industry’s overall health. Some analysts project a bullish trend for the company’s shares, especially if it continues to gain market share amidst fierce competition from other travel booking platforms.

Furthermore, the company’s commitment to sustainability and digital transformation also appeals to socially conscious investors looking to align with eco-friendly businesses. The emphasis on technology-driven solutions aims to streamline operations and enhance customer satisfaction, which investors see as a long-term growth strategy.

Conclusion

In conclusion, the performance of EaseMyTrip shares holds significant importance not just for the company but also for the broader travel industry in India. As the economy gradually stabilizes and travel demand peaks, stakeholders must keep a close eye on market trends and company developments. Investors are advised to consider both current performance metrics and future potential as they explore opportunities within the growing online travel sector. The outlook for EaseMyTrip shares remains optimistic, with potential for continued growth in the coming quarters.