Everything You Need to Know About Vidya Wires IPO

Introduction

Vidya Wires, a leading manufacturer in the wires and cables sector, has recently announced its Initial Public Offering (IPO), generating significant interest among investors and market analysts. The IPO, set to launch on [insert launch date], has implications not only for the company but also for the overall stock market, reflecting the buoyancy of the Indian economy amidst global uncertainties.

Details of the IPO

According to the company’s filings with the Securities and Exchange Board of India (SEBI), the Vidya Wires IPO aims to raise approximately [insert amount] through the issuance of [insert number] equity shares. The price band has been set between [insert range] per share, appealing to a wide range of investors from retail to institutional. The fund raised through this IPO is expected to be utilized for expanding production capacities, enhancing R&D efforts, and serving as working capital.

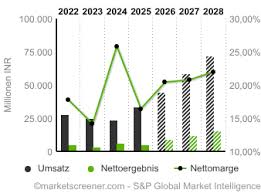

As per the company’s management, Vidya Wires has seen robust growth in recent years, with a compound annual growth rate (CAGR) of [insert percentage] in revenues over the last five years. The rising demand for electrical wires due to infrastructural development and the push for renewable energy sources has positioned the company for a promising future.

Market Trends and Analysis

The wires and cables market in India is projected to grow significantly due to increasing demand from sectors such as construction, automotive, and telecommunications. Analysts predict that Vidya Wires could be one of the front runners in this booming market, given their established brand reputation and competitive pricing strategy.

Investors are particularly keen on the performance of the IPO within the context of recent IPO trends in India. Reports indicate that several recent IPOs have witnessed oversubscription, reflecting strong investor confidence in the market. This sentiment may also bode well for Vidya Wires as it looks to attract both retail and institutional investment during its offering.

Conclusion

As the Vidya Wires IPO approaches, it holds significant potential for investors looking to capitalize on emerging opportunities in India’s robust manufacturing sector. The company’s growth trajectory and strategic plans suggest that it could be a valuable addition to many investment portfolios. Looking ahead, market observers will be closely monitoring the IPO’s reception, as it could set the tone for future public offerings in the sector. Investors are advised to stay updated on further developments and consider professional financial advice to make informed decisions.