Microsoft Share Price: Trends and Analysis in 2023

Introduction

The share price of Microsoft Corporation, a global technology giant, holds significant importance for investors and analysts alike. As a barometer of the company’s financial health and market sentiment, understanding the current trends in Microsoft’s share price is crucial for making informed investment decisions.

Current Trends and Analysis

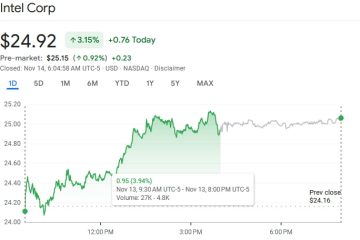

As of October 2023, Microsoft’s share price is experiencing a notable fluctuation influenced by various factors, including market conditions, earnings reports, and macroeconomic indicators. The company’s share price has reached approximately $345, a percentage increase of around 10% from the beginning of the year.

This growth follows a robust earnings report released in September, where Microsoft reported a 15% increase in revenue year-over-year, largely driven by its cloud computing services and subscription models. Analysts have noted that the expansion of Azure and Office 365 has continued to bolster Microsoft’s profitability.

Moreover, the recent developments in artificial intelligence and their integration into Microsoft products have also sparked investor interest. The collaboration with OpenAI to enhance software features demonstrates Microsoft’s commitment to innovation, which is expected to yield long-term financial benefits.

Market Reactions and Investor Sentiment

Market analysts have been actively discussing the implications of these financial results on Microsoft’s stock. Investor sentiment remains optimistic, but there is caution ahead of future Federal Reserve meetings, which may affect technology stocks broadly. Some analysts suggest that potential interest rate hikes could dampen the share price’s growth.

Additionally, with increasing competition from tech rivals such as Google and Amazon, the pressure to maintain market share is palpable. Hence, Microsoft must continue to innovate and adapt to the changing landscape of technology.

Conclusion

In conclusion, Microsoft’s share price trajectory in 2023 reflects both its strong business fundamentals and the prevailing market dynamics. While current trends indicate a positive outlook, investors should stay vigilant regarding economic factors that could impact tech stocks. Continuous monitoring of Microsoft’s performance metrics and market conditions will be essential for making strategic investment decisions moving forward.