Today’s GMP for Capillary Technologies IPO: Key Insights

Introduction

The Initial Public Offering (IPO) of Capillary Technologies has garnered substantial attention in the financial markets recently. With a significant emphasis on the tech industry’s expansion in India, understanding the Gross Market Price (GMP) of the Capillary Technologies IPO is crucial for investors. GMP reflects the premium or discount investors are willing to pay over the issue price, providing insights into market sentiment.

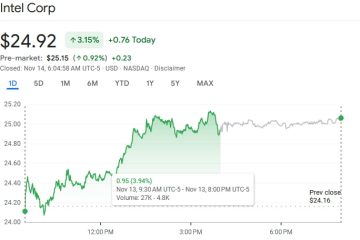

Current GMP Analysis

As of today, the GMP for Capillary Technologies’ IPO stands at approximately ₹120, indicating a robust demand among investors. The IPO itself is priced in the range of ₹400-₹450 per share, and with the current GMP standing at ₹120, it projects a potential listing price between ₹520-₹570, if market conditions remain favorable. Analysts predict this strong GMP is driven by the company’s solid financial performance and robust growth potential in the digital solutions space.

Market Reactions

Investor enthusiasm can be attributed to recent performances of tech IPOs in the Indian market. Notably, tech stocks have seen a resurgence, with investors increasingly looking for avenues for growth amid global economic uncertainties. Capillary Technologies, known for its innovative customer engagement solutions, has positioned itself as a promising player in this space. The recent buzz surrounding its IPO indicates a positive outlook from institutional and retail investors alike.

Conclusion

In conclusion, the current GMP of Capillary Technologies at ₹120 highlights strong investor interest and confidence in the tech sector’s growth potential. As the IPO date approaches, it will be essential for potential investors to monitor market trends, developments, and other IPO performances. The significance of GMP cannot be understated, as it informs investment decisions and reflects overall market sentiment. Looking ahead, Capillary Technologies appears to be set for a successful debut, contributing to the momentum of the Indian tech IPO landscape.