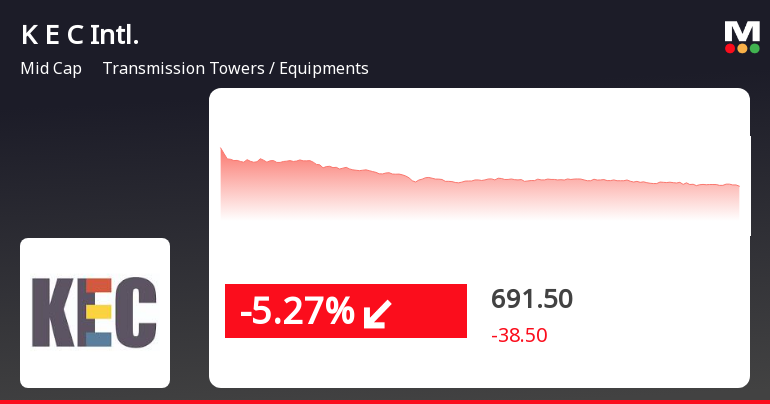

KEC Share Price: Recent Trends and Market Insights

Introduction

The share price of KEC International Limited, a leading global player in infrastructure and engineering, has become a focal point for investors and market analysts alike. Understanding its recent performance can provide valuable insights into the company’s operational health and strategic initiatives, particularly in the wake of various economic factors influencing the market.

Recent Trends

As of October 2023, KEC’s share price has shown notable fluctuations, reflecting both domestic and international market conditions. The stock recently traded around INR 500 per share, showcasing a ~5% increase from previous months, primarily driven by robust quarterly results and increased order bookings. Analysts attribute this growth to KEC’s strategic project acquisitions and diversification into renewable energy, which are critical for future revenue streams.

Market Performance

In the last quarter, KEC has secured several large-scale contracts worth over INR 1,000 crores, contributing significantly to investor confidence. The company’s focus on enhancing its operational efficiency and expanding its geographic footprint has also played a crucial role in its stock performance. Furthermore, the ongoing government initiatives to bolster infrastructure development in India are likely to catalyze further growth for KEC, positioning it favorably for future investments.

Forecast and Significance

Market analysts predict that KEC’s share price could experience further upward momentum in the coming months, particularly if the company maintains its order book expansion and continues to innovate in new markets. For investors, KEC presents a potential opportunity given its existing portfolio and ambitious growth trajectory. However, they must also consider global economic uncertainties and competition within the sector, which may impact future performance.

Conclusion

In conclusion, KEC’s share price reflects a combination of operational success and market dynamics, making it a critical stock to watch for those involved in the infrastructure sector. The company’s proactive stance on project acquisition and market diversifications positions it well for sustainable growth, but potential investors should stay informed about market conditions that could influence its share price moving forward.