Latest Trends in Paytm Share Price: What Investors Need to Know

Introduction

The share price of Paytm, one of India’s leading digital payment platforms, is of significant interest to investors and market analysts alike. Following its much-anticipated IPO in November 2021, Paytm’s stock has seen a roller-coaster ride, making it a topic of intense scrutiny and discussion. Understanding the current trends and underlying factors affecting Paytm’s share price is crucial for investors looking to navigate the volatile market.

Recent Performance

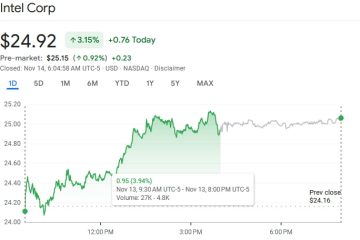

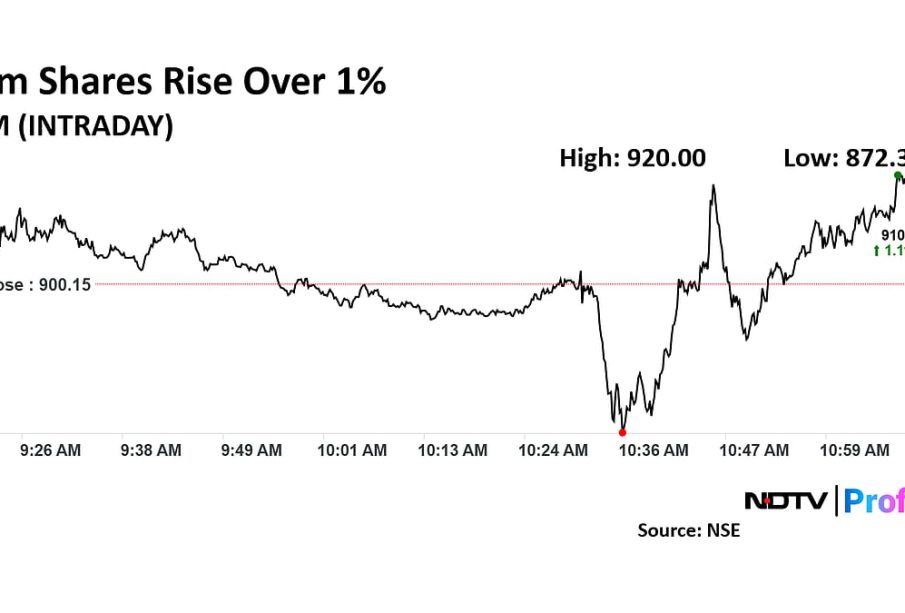

As of late October 2023, the share price of Paytm has shown a slight recovery from its earlier lows. After closing at ₹582 on October 22, 2023, the shares experienced a marginal increase, clocking in at ₹598 on October 25. This recent uptick has been attributed to several factors, including a positive quarterly earnings report that exceeded analysts’ expectations, indicating a resurgence in user engagement and transaction volumes.

Market Sentiment and Analysis

Analysts suggest that the overall positive sentiment around the Indian fintech sector is bolstering the share price. Paytm, which reported growth in its subscription revenues and improved cash flow, is seen as a key player in this expanding market. Moreover, the mood among retail investors appears optimistic, as they are gradually but steadily increasing their holdings in the stock.

However, challenges remain. Competition from other digital payment platforms, regulatory scrutiny, and macroeconomic factors such as inflation and interest rates continue to pose risks. The need for continual innovation and user engagement strategies remains paramount for Paytm to sustain its market position and attract investor confidence.

Future Outlook

Looking ahead, Paytm’s share price is likely to be influenced by its performance in the upcoming festive season, traditionally a high transaction period for retailers. Analysts are closely watching how effectively Paytm can capitalize on this opportunity while expanding its services in areas like financial products and digital loans.

Conclusion

In conclusion, Paytm’s share price remains a focal point for investors, reflecting broader trends in the digital payments landscape. While the current recovery in share price offers a glimmer of hope, potential investors should remain cautious and informed about the evolving market dynamics and Paytm’s strategic responses. As India continues its digital financial transformation, Paytm’s performance will be a key indicator of the sector’s health moving forward.