South Indian Bank Share Price: Latest Trends and Analysis

Introduction

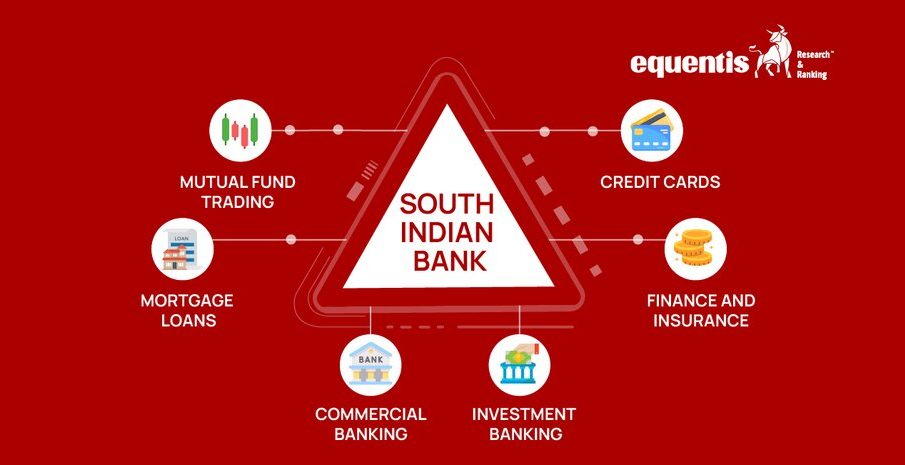

South Indian Bank, one of the prominent private sector banks in India, has been under the spotlight lately due to fluctuations in its share price. Investors and market analysts closely monitor these changes, as they reflect the bank’s financial health, market position, and overall economic trends. Understanding the current share price trends is essential for investors looking to make informed decisions.

Current Share Price Analysis

As of the latest trading session on October 20, 2023, the share price of South Indian Bank stood at approximately INR 15.25 per share. This marks a notable change compared to previous weeks, where the price hovered around INR 14.50. Analysts attribute this rise to several factors, including positive quarterly earnings, an increase in net interest income, and a robust growth outlook in retail banking segments.

Factors Influencing Share Price

The fluctuation in South Indian Bank’s share price can be traced back to various elements. Firstly, the bank reported a 20% increase in net profit for Q2 FY2024, reaching INR 150 crores, which exceeded market expectations. This positive earning report has bolstered investor confidence. Secondly, broader economic conditions, such as falling interest rates and an uptick in loan demand, have created a favorable environment for banking stocks, including South Indian Bank.

Recent Developments

Certain strategic initiatives by South Indian Bank are likely to impact its share price in the near future. The bank has recently announced plans to enhance its digital banking services, aiming to attract a younger demographic. Furthermore, its expansion into underserved areas is set to capture a larger market share, potentially leading to increased profits. Additionally, the bank’s board has approved a dividend payout, which tends to create a positive response from the market during such announcements.

Conclusion and Future Outlook

Given the current trajectory of South Indian Bank’s share price and its recent financial performance, there seems to be a bullish outlook for the upcoming quarters. Analysts suggest that as long as the bank continues to innovate and adapt to changing market conditions, the share price may continue to rise. For investors, this provides an opportune moment to evaluate potential benefits of investing in South Indian Bank. However, as with all investments, it remains crucial to analyze risks and market variations carefully.