Current Trends in Hero MotoCorp Share Price

Introduction

The share price of Hero MotoCorp, India’s leading two-wheeler manufacturer, is a significant barometer of the automotive industry’s health. With the growing demand for electric vehicles and a recovering economy post-pandemic, understanding the fluctuations in Hero MotoCorp’s share price is crucial for investors, stakeholders, and auto enthusiasts alike.

Latest Price Trends

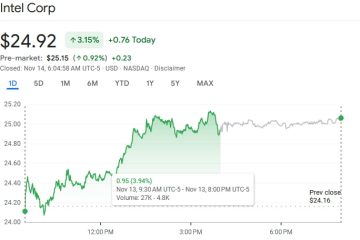

As of October 2023, Hero MotoCorp’s shares have shown considerable volatility due to changing market sentiments and economic conditions. The shares were trading around ₹3,000 per share at the beginning of the month, reflecting a surge attributed to strong quarterly results and forecasts indicating potential growth in electric scooters.

In recent weeks, the stock has fluctuated between ₹2,950 and ₹3,050. Investors are cautiously optimistic, as the company has reported a 10% increase in sales compared to the previous quarter. Experts attribute this growth to the introduction of new models and an expanding customer base looking for sustainable transport options.

Factors Influencing Share Price

Several factors are influencing Hero MotoCorp’s share price at present:

- Market Demand: Increasing demand for two-wheelers, especially in rural areas, supports a favorable outlook.

- Electric Vehicle Strategy: With investments in electric mobility, the company is positioning itself to capture a share of the EV market which is expected to expand significantly.

- Economic Indicators: Macroeconomic factors such as inflation rates and consumer spending play a vital role in shaping investor confidence.

Investment Insights

Analysts recommend monitoring the following aspects before making investment decisions:

- Performance of new models in the market.

- Updates on government policies regarding EV subsidies and incentives.

- Broader economic trends influencing disposable incomes and consumer behavior.

Conclusion

Hero MotoCorp’s share price serves as a mirror reflecting both the immediate market conditions and the company’s strategic positioning in a rapidly changing automotive landscape. For potential investors, regular monitoring of these trends is essential. With a focus on innovation and sustainable practice, the company aims to maintain its lead, making its share price an important factor to watch as India pivots towards a greener future.