Current Trends in IndusInd Bank Share Price

Introduction

IndusInd Bank has emerged as a prominent player in India’s banking sector, catering to a diverse clientele with its wide range of financial services. Monitoring the share price of IndusInd Bank is crucial for investors and stakeholders as it reflects the bank’s financial health and future prospects. In recent months, the stock has attracted considerable attention due to fluctuating market conditions and economic factors.

Recent Developments

As of October 2023, IndusInd Bank’s share price has exhibited a dynamic trajectory influenced by various internal and external factors. Following the release of its quarterly results, the bank reported a net profit increase of 20% year-on-year, driven by strong credit growth and improved asset quality. This positive performance has bolstered investor confidence, resulting in a rise in share valuations.

Furthermore, the banking sector is poised to benefit from the Reserve Bank of India’s recent interest rate policy, which aims to stimulate economic growth. Analysts suggest that IndusInd Bank, with its robust lending portfolio, stands to gain significantly from an uptick in credit demand.

Market Sentiment and Analytical Insights

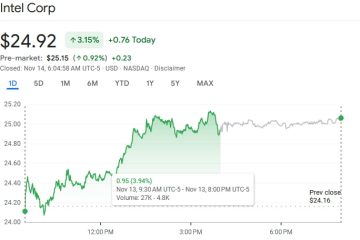

Financial experts observe that the share price of IndusInd Bank has been buoyed by increasing foreign institutional investments (FIIs) and favorable economic indicators. The bank’s stock traded at approximately ₹1,300 in early October and has continued to trend upward amid positive market sentiment.

Technical analysis indicates that the stock faces resistance at the ₹1,350 mark, while the support level is currently around ₹1,250. Investors are advised to watch for market news and global trends that may impact the banking sector, which could further influence share performance.

Conclusion

IndusInd Bank’s share price remains a focal point for investors seeking viable opportunities in the Indian financial markets. With promising earnings growth and a supportive economic environment, the bank presents a strategic investment choice. Potential investors should conduct thorough research and consider macroeconomic factors before making investment decisions. As the market continues to evolve, keeping abreast of the latest trends will be vital for anyone interested in IndusInd Bank’s financial journey.