IRB Infra Share Price: Latest Trends and Insights

Introduction

IRB Infrastructure Developers Ltd, a leading player in the infrastructure sector in India, has been in the spotlight due to its significant contributions to various projects across the country. The company’s share price is not only a reflection of its operational performance but also an indicator of market sentiment towards the infrastructure sector. As the demand for infrastructure projects continues to rise in India, understanding the dynamics of IRB Infra’s share price becomes increasingly important for investors and stakeholders.

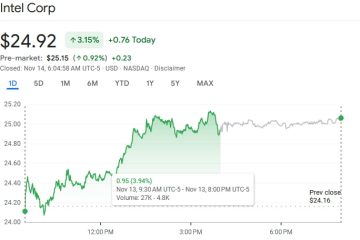

Current Share Price Trends

As of the latest trading session, IRB Infra’s share price has seen fluctuations, reflecting broader market trends and company-specific news. The stock recently traded at approximately ₹216 per share. This price represents a 5% increase over the previous week, driven by positive investor sentiment following the announcement of new project developments and government initiatives aimed at enhancing infrastructure investment.

Factors Influencing the Share Price

The share price of IRB Infra is influenced by several key factors:

- Government Policies: The Indian government’s focus on infrastructure development, particularly under the National Infrastructure Pipeline (NIP), boosts investor confidence.

- Project Wins: Recent contracts awarded to IRB Infra for highway construction and maintenance projects augment its revenue forecasts, positively impacting its stock price.

- Market Sentiment: Broader market trends and investor sentiment play a significant role, especially in the wake of economic recovery efforts post-pandemic.

Recent Developments

In August 2023, IRB Infra announced the successful completion of several road projects, which not only enhanced its earnings but also strengthened its order book. Additionally, they secured new tenders that are expected to contribute significantly to their long-term revenue. Analysts are bullish on the prospects of IRB Infra shares due to this pipeline of project work.

Conclusion

For investors, the trajectory of IRB Infra’s share price remains a vital metric in analyzing potential returns from investments in the infrastructure sector. Given the government’s commitment to expanding infrastructure, along with the company’s robust project management capabilities, many analysts predict continued growth for IRB Infra shares. Stakeholders should closely monitor market conditions, government policies, and the company’s project performance to make informed investment decisions.