Current Trends in NBCC Share Price: Insights and Analysis

Importance of Monitoring NBCC Share Price

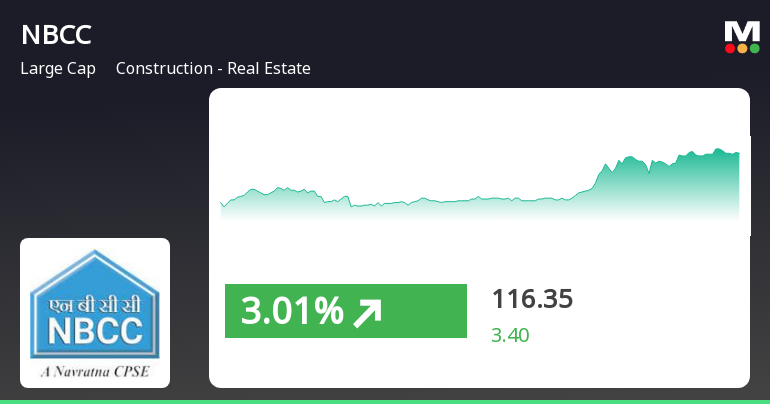

The share price of National Buildings Construction Corporation (NBCC) is a crucial indicator for investors and stakeholders in the construction and real estate sector. As a public sector enterprise, NBCC plays a significant role in the development of infrastructure projects across India. Understanding the fluctuations in its share price is vital for making informed investment decisions.

Recent Performance and Market Trends

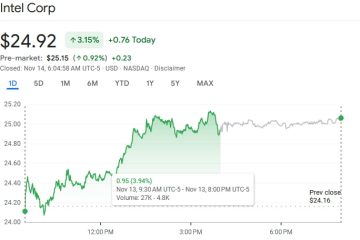

As of October 2023, NBCC’s share price has shown considerable volatility, influenced by various factors including government policies, infrastructure spending, and overall market sentiment. Analysts have observed that the stock hit a peak of INR 58 in late September but experienced a correction to around INR 52 by the first week of October.

This change can be attributed to recent governmental announcements aimed at boosting infrastructure development, which positively impacts companies like NBCC. Additionally, global economic factors, including fluctuations in raw material costs and international trade relations, have also played a role in shaping investor sentiment towards the stock.

Factors Influencing NBCC Share Price

1. **Government Policies**: NBCC often benefits from increased government spending on infrastructure and housing projects. Policy changes and budgets announced by the government significantly influence investor confidence.

2. **Market Sentiment**: The overall performance of the stock market and investor behavior can heavily impact NBCC’s share price. Economic conditions, including inflation rates and interest rates, also contribute to market sentiment.

3. **Company Performance**: Quarterly financial results, project acquisitions, and contract wins are crucial for performance evaluations. Investors closely analyze these reports for insights into future profitability.

Conclusion and Future Outlook

In conclusion, tracking the NBCC share price is essential for investors aiming to capitalize on its potential growth within the booming infrastructure sector. With the government’s renewed focus on infrastructure development, analysts predict that NBCC shares might recover from recent corrections and show upward momentum.

Looking ahead, investors should keep an eye on global economic indicators, government policy changes, and industry trends to assess how these factors will shape the future of NBCC’s share price. As always, potential investors are encouraged to conduct thorough research or consult financial advisors before making investment decisions.