Paytm Share Price Trends and Market Insights

Introduction

In recent years, digital payment platforms have surged in popularity, and Paytm has emerged as a leading player in this sector. As one of India’s foremost fintech companies, understanding the fluctuations and current status of Paytm’s share price is crucial for investors, stakeholders, and market enthusiasts. With its public listing and initial struggles, the analysis of Paytm’s share price trajectory provides insights into the health of the fintech industry as a whole.

Recent Developments

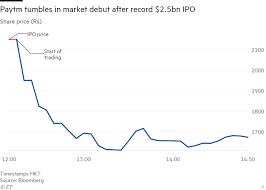

As of mid-November 2023, Paytm’s share price has shown considerable volatility. After its IPO in November 2021 at ₹2,150, the stock faced significant challenges, dipping below ₹1,000 shortly thereafter. However, recent reports indicate a resurgence, with shares reaching approximately ₹850, as investors remain optimistic about the company’s growth potential, particularly in the wake of expanding e-commerce activities and increased digital adoption in India.

Factors Influencing Share Price

Several elements are contributing to the fluctuations in Paytm’s share price:

- Market Sentiment: Investor sentiment has shifted positively due to relief in overall market conditions and promising earnings reports.

- Revenue Forecasts: Analysts have projected a growth in Paytm’s revenue stream backed by increasing transactions in digital payments and merchant services.

- Competition: The evolving competitive landscape, with players like PhonePe and Google Pay, continues to influence perceptions of Paytm’s market position.

Analysis and Outlook

Analysts believe that the future of Paytm’s share price will hinge on its ability to innovate and adapt to the fast-evolving digital landscape. The company’s recent innovations in technology and payment solutions are anticipated to improve user engagement and, in turn, market performance. Additionally, upcoming quarterly earnings results could serve as a critical juncture for Paytm’s stock, offering insights into its profitability and growth trajectory.

Conclusion

For investors, keeping an eye on Paytm’s share price is more than just monitoring stock value; it reflects broader trends in the fintech industry and consumer behavior in India. As the company navigates competitive pressures and strives to enhance its service offerings, stakeholders should remain informed about strategic decisions and market analytics that may affect share price in the months to come. A stable recovery in share price could be a sign of increased investor confidence in one of India’s most recognized fintech firms.