An Insight into Michael Burry and Scion Capital

Introduction

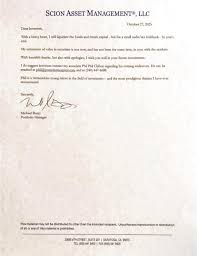

Michael Burry, known for his foresight in predicting the 2008 financial crisis, continues to capture the attention of investors and analysts alike. His hedge fund, Scion Capital, has become synonymous with innovative investment strategies that often defy conventional wisdom. Understanding his current investment decisions is crucial for both individual investors and financial enthusiasts, given the volatility and unpredictability of today’s markets.

Recent Developments at Scion Capital

As of 2023, Michael Burry has made headlines with his contrasting views on various market sectors. His recent filings reveal that Scion Capital has taken significant positions in sectors such as technology, despite skepticism from other market analysts. Burry’s investment approach focuses on identifying undervalued assets that hold potential for substantial growth, a strategy he famously employed during the 2008 housing market collapse.

Among his recent investments, Burry has shown interest in companies that are perceived to be undervalued amid current economic uncertainties, particularly during periods of high inflation and rising interest rates. His calculated bets against certain technology stocks, seen by many as overvalued, exemplify his contrarian investment philosophy.

Investment Philosophy and Strategy

What sets Michael Burry apart from many other hedge fund managers is his meticulous research and willingness to take on significant risks. He advocates for a deep dive into financial statements and market trends, which offers a solid foundation for investment decisions. His belief in the power of thorough analysis has allowed him to thrive in both bullish and bearish markets.

Moreover, Burry’s public warnings about economic bubbles and inflationary pressures reflect a cautious but strategic outlook. He frequently updates his followers through social media, emphasizing the importance of staying informed about market dynamics for effective investing.

Conclusion

Michael Burry and Scion Capital remain a focal point in the investment community as they navigate complex market conditions. Investors looking to emulate Burry’s success must embrace a rigorous analytical approach, be prepared for volatility, and maintain a contrarian perspective when necessary. As economic conditions continue to evolve, the importance of being adaptable and well-informed cannot be understated. Observing Burry’s moves could potentially offer valuable insights for investors aiming to withstand market fluctuations in the years to come.