Latest Updates on Bharat Forge Share Price

Introduction

The share price of Bharat Forge, one of the leading manufacturers of automotive components in India, is a focal point for investors and analysts alike. With its presence across various sectors such as defense, aerospace, and railways, Bharat Forge’s stock performance reflects both market sentiments and the broader economic landscape. Tracking its share price is essential for investors looking to make informed decisions in a rapidly changing market environment.

Current Market Trends

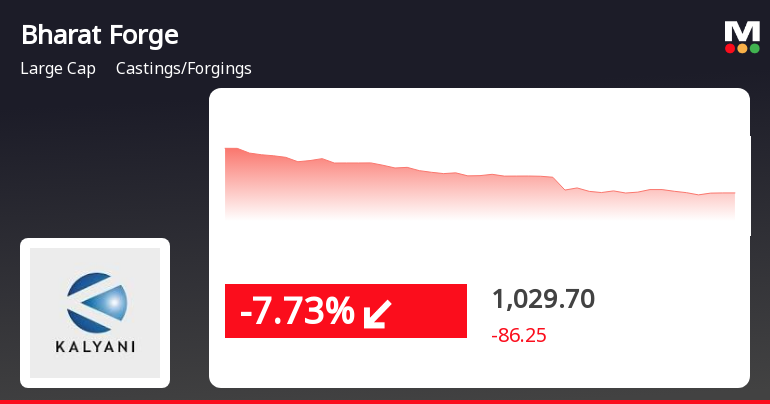

As of October 2023, Bharat Forge shares have exhibited significant volatility. After a robust performance earlier in the year, where the stock reached an all-time high of ₹830 per share, the stock saw a correction due to a dip in demand across global automotive markets and rising raw material costs. Currently, the share price hovers around ₹740, which remains a point of contention among investors.

Factors Influencing Share Price

Several factors contribute to the fluctuations in Bharat Forge’s share price. The recent slowdown in the automotive sector due to semiconductor shortages and global supply chain disruptions has directly impacted investor confidence. Additionally, the geopolitical scenario and its implications on defense spending have resulted in mixed forecasts for Bharat Forge’s defense segment revenue. However, the company’s diversification into electric mobility and renewable energy components has provided some optimism for its long-term growth prospects.

Future Projections

Market analysts suggest that the outlook for Bharat Forge’s share price could improve, especially as the global economy stabilizes. The company’s strategic investments in technology and emphasis on sustainability are expected to resonate well in an increasingly environmentally-conscious market. If the automotive sector rebounds and demand for infrastructure improves, many expect the stock could reclaim its previous highs in the next few months.

Conclusion

For current and potential investors in Bharat Forge, staying abreast of market trends and company performance is crucial. With a forecasted recovery in the global economy and strategic growth initiatives, Bharat Forge remains a stock to watch. Analysts recommend a cautious yet optimistic approach, balancing the inherent risks with potential rewards as the company navigates through current market challenges.