Current Trends in Hindustan Copper Share Price

Introduction

The share price of Hindustan Copper Limited (HCL) is currently a significant topic of interest for investors and financial analysts. As a leading player in the copper mining sector in India, its stock not only reflects the company’s performance but also the wider trends in the metal and mining industry. Understanding the fluctuations in Hindustan Copper’s share price can provide insights into market dynamics influenced by global commodity prices, economic growth prospects, and company-specific developments.

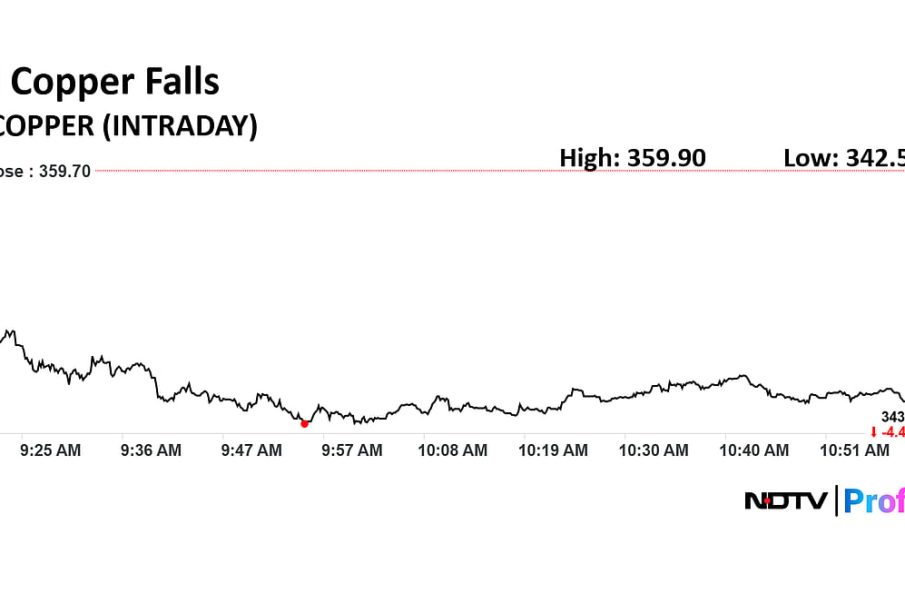

Recent Price Movements

As of October 2023, Hindustan Copper’s share price has shown considerable volatility, reflective of both local economic conditions and international copper prices. Recent reports indicate that Hindustan Copper’s stock is trading at approximately ₹120 per share, which marks a 5% increase over the past month. Analysts attribute this rise to an uptick in demand for copper driven by infrastructure projects and green energy initiatives, where copper is a critical component.

Market Influences

Factors affecting Hindustan Copper’s stock include changes in global copper prices, which are often tied to major developments in industries such as construction, automotive, and renewable energy. With the increasing emphasis on electric vehicles (EVs) and renewable energy technologies, copper demand is anticipated to rise further, adding upward pressure on prices. Furthermore, government policies encouraging domestic mining and production of metals have positioned Hindustan Copper to potentially capitalize on increased domestic demand.

Financial Performance

The company’s financial results for Q2 FY2023 indicate robust revenue growth, with a year-on-year increase of 20%. This growth reflects the company’s successful cost management and operational efficiencies, which are crucial in a sector that often faces challenges from fluctuating commodity prices and operational risks. Such financial stability has boosted investor confidence, contributing to the recent price increase.

Investor Outlook

Looking ahead, analysts suggest watching external factors such as Chinese manufacturing data and global economic indicators that can influence copper prices. With forecasts anticipating a continued rise in demand for copper, Hindustan Copper could remain a strong investment option for long-term investors. However, market analysts also caution investors about potential volatility stemming from geopolitical tensions and the global economic slowdown, which can impact commodity markets significantly.

Conclusion

In conclusion, Hindustan Copper’s share price is currently experiencing positive momentum, driven by strong demand fundamentals and the company’s robust financial performance. Investors should stay informed about market trends and economic indicators that could affect copper prices moving forward. With a significant role in India’s mining sector, Hindustan Copper remains an intriguing prospect for those looking to invest in commodities and gain exposure to an essential industrial metal.