Understanding Biocon Share Price Trends in 2023

Introduction

Biocon Limited, a leading biopharmaceutical company in India, has been making headlines with its fluctuating share price in 2023. Understanding the dynamics of Biocon’s share price is crucial for investors and stakeholders, as it reflects the company’s market performance and growth prospects in the competitive pharmaceutical sector.

Current Trends and Market Performance

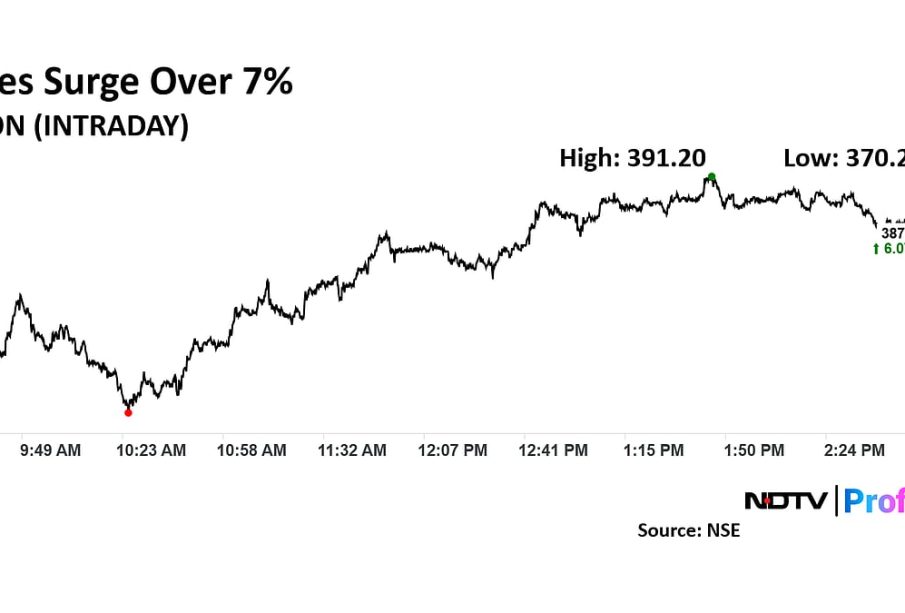

As of October 2023, Biocon’s share price has seen significant volatility. The stock opened the month at INR 400 per share; however, recent market trends have seen it dip to around INR 350. Analysts attribute this decline to various factors, including global market instability, regulatory challenges, and competitive pressure from both domestic and international players.

In the past quarter, the company’s performance has been impacted by a slowdown in its biosimilars segment, which was previously a strong driver of growth. However, Biocon’s recent announcement regarding a strategic partnership for the development of a new drug candidate has sparked interest among investors, leading to a slight recovery in share price towards the end of September.

Factors Influencing Biocon’s Share Price

Several factors play a crucial role in influencing Biocon’s share price:

- Market Sentiment: Investor confidence significantly affects stock prices. Negative news in the pharmaceutical sector often leads to a decline in share prices.

- Regulatory Approvals: The timeline for approvals from regulators, such as the FDA, can uplift or drop stock value, based on market expectations.

- Financial Performance: Quarterly earnings reports provide insights into revenue growth and profit margins, impacting share price.

- Global Economic Conditions: Economic factors, including inflation rates and currency fluctuations, affect investor sentiment and stock performance.

Conclusion

For investors, closely monitoring Biocon’s share price and the factors influencing it is essential for making informed investment decisions. With ongoing developments in the biopharmaceutical industry and regulatory landscape, predicting future trends in Biocon’s share price remains complex. Analysts suggest that while some volatility is expected, potential upside exists due to strategic initiatives the company is pursuing. Keeping an eye on the company’s announcements and market movements will be key for stakeholders in the coming months.