Latest Analysis of RBL Bank Share Price

Introduction

RBL Bank, one of India’s leading private sector banks, has been under scrutiny due to its fluctuating share price in recent months. Investors and analysts alike are keeping a close watch on market trends affecting the bank’s stock as it plays a significant role in the Indian banking sector. Understanding the dynamics of RBL Bank’s share price is crucial for both prospective and current investors.

Current Market Performance

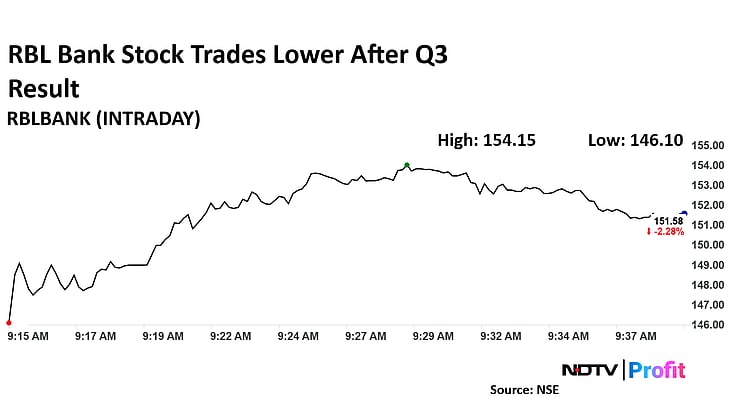

As of October 2023, the share price of RBL Bank has shown considerable volatility despite a generally positive trend in the banking sector. Currently, the stock is trading around ₹200, reflecting a slight decrease from the previous week. Analysts attribute this fluctuation to recent macroeconomic factors, including inflation concerns and regulatory changes impacting financial institutions.

Throughout the past few weeks, RBL Bank shares have experienced both highs and lows, largely driven by investor sentiment and market news. Reports of improving asset quality and growth in net interest margins have provided some buoyancy to the stock. However, competition among private and public sector banks continues to pose challenges.

Factors Influencing Share Price

The performance of RBL Bank’s share price can be linked to several underlying factors:

- Economic Indicators: Changes in fiscal and monetary policies, alongside inflation rates, can heavily influence banking stocks.

- Bank Performance: RBL Bank’s quarterly earnings, including net profit and asset growth, play a critical role in determining investor confidence.

- Market Sentiment: As with any stock, broader market trends and investor sentiment toward the banking sector contribute to share price movements.

- Regulatory Developments: Decisions made by the Reserve Bank of India (RBI) regarding interest rates and banking regulations can also lead to significant shifts in stock prices.

Conclusion

In conclusion, the performance of RBL Bank’s share price is influenced by a mixture of internal bank performance metrics and external economic factors. Given the complexities of the banking environment, investors are advised to remain vigilant, watching for both positive developments and potential hurdles. Moving forward, analysts suggest that a keen eye on the bank’s upcoming quarterly results and regulatory news will be essential in forecasting the share price’s trajectory.