Current Trends in Union Bank Share Price

Introduction

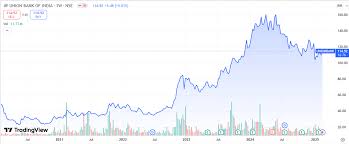

The share price of Union Bank of India is significant not only for investors but also for the overall banking sector in India. As one of the leading public sector banks, fluctuations in its share price can indicate wider economic trends and investor sentiment. Understanding these movements is essential for investors looking to make informed decisions.

Current Market Overview

As of the latest trading session on 15th October 2023, Union Bank’s share price has shown notable volatility, closing at ₹100. The stock has experienced a rise of approximately 12% over the last month, following reports of increased profitability and robust loan growth among public sector banks. Analysts attribute this surge to improved asset quality and a positive outlook on the banking sector as a whole.

Factors Influencing Share Price

Several key factors are influencing the current share price of Union Bank:

- Financial Results: The bank’s latest quarterly results, showcasing a net profit increase of 30% year-on-year, have bolstered investor confidence.

- Government Policies: Recent favorable policies by the Reserve Bank of India aimed at boosting liquidity have positively impacted the banking sector.

- Market Sentiment: Broader market trends, including a bullish sentiment across the Nifty and Sensex indices, are contributing to confidence in financial stocks.

Investor Perspective

For potential investors, analysts recommend a cautious approach. While the recent performance is encouraging, it’s important to consider the macroeconomic environment, including inflation rates and global economic conditions. Investors are advised to keep an eye on Union Bank’s strategic initiatives, especially in digital banking and risk management, as these will be pivotal for sustainable growth.

Conclusion

The share price of Union Bank of India remains a hot topic among investors, reflecting the performances and expectations of the banking sector. Given the upward trends in share price and positive financial indicators, there seem to be promising opportunities for current and prospective shareholders. However, continual monitoring of economic indicators and bank-specific developments will be crucial for navigating potential risks and making informed investment decisions.