Understanding CDSL Share Price: Trends and Insights

Introduction

The Central Depository Services Limited (CDSL) has been a notable player in the Indian financial market since its establishment in 1999. With the increasing participation of retail investors in the stock market, the understanding of CDSL’s share price and its fluctuations has become critically relevant. As a key provider of depository services in India, the performance of CDSL shares is indicative of broader market trends and investor sentiment.

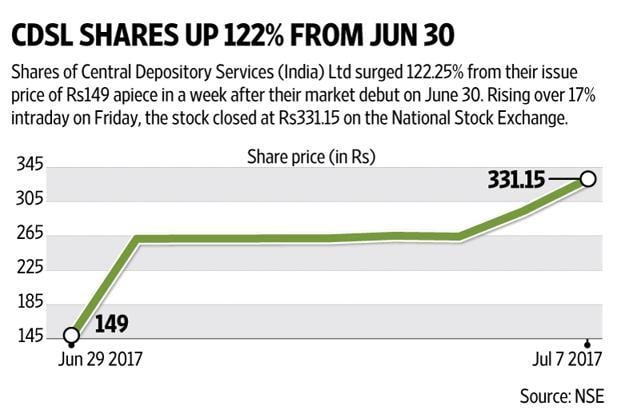

Recent Trends in CDSL Share Price

As of October 2023, CDSL’s share price has witnessed significant volatility in line with market trends and regulatory changes. The share price peaked at around ₹1,000 earlier this year but has experienced fluctuations, currently trading around ₹850. Analysts attribute this volatility to various factors including changes in market regulations, competition from other depositories, and shifts in investor behavior.

In recent months, CDSL has reported a 20% increase in its quarterly profits, which has positively influenced its stock price. Furthermore, the company has expanded its services to offer a wider array of financial products, which is a strategic move towards enhancing its market share and competitiveness.

Market Events Influencing CDSL Share Price

Several key events have impacted CDSL’s share price. The announcement of new digital initiatives aimed at improving customer experience has been well received by investors. Additionally, the company’s successful technology upgrades have led to improvements in operational efficiency. These advancements have fostered investor confidence, despite the overall uncertainty in the broader market.

Moreover, the increasing trend of digitalization in the Indian economy has provided a favorable backdrop for CDSL. As more investors opt for digital trading platforms, the demand for depository services is poised to grow, potentially driving up share prices in the longer term.

Conclusion

CDSL’s share price movements are not only a reflection of its individual performance but also serve as a barometer for the Indian financial market’s health. Investors keenly watch this stock due to its potential for growth in a digitally evolving environment. While the short-term fluctuations may present challenges, the long-term outlook appears optimistic given the broader economic trends. Stakeholders should remain informed of market dynamics, taking into account both CDSL’s operational advancements and external market conditions, to make well-informed investment decisions.