Current Trends and Future Predictions for Ethereum Price

Introduction

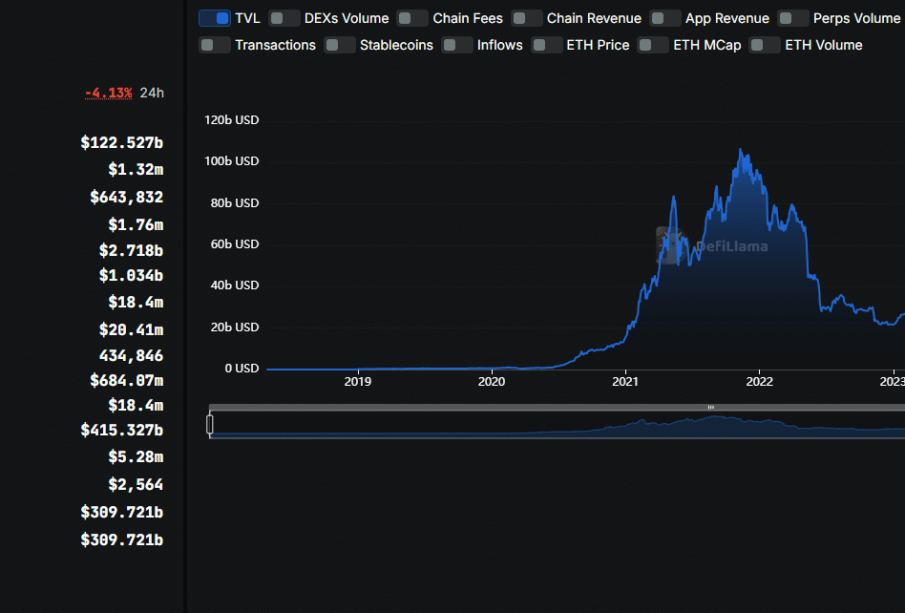

The Ethereum price holds significant importance in the world of cryptocurrencies, as it drives the market trends and investor sentiments. As the second-largest cryptocurrency by market capitalization, Ethereum plays a critical role in blockchain technology and decentralized applications. Understanding the current price dynamics is essential for investors and enthusiasts alike, especially with ongoing developments in the crypto space.

Recent Developments Affecting Ethereum Price

As of October 2023, Ethereum’s price has been impacted by a variety of factors including regulatory changes, technological advancements, and market trends. The Ethereum network is on the verge of further upgrades aimed at improving scalability and reducing transaction fees. These upgrades have led to a renewed interest in Ethereum amongst developers and investors, thereby influencing the price positively.

Recently, Ethereum is trading at approximately $2,000, showing a steady increase from the previous month, where it had dipped to around $1,800. This upward trend can be attributed to the recent implementation of Ethereum Improvement Proposal (EIP) 1559, which has the potential to make transactions more efficient and reduce inflationary pressures on the currency.

Market Sentiment and Investor Interest

The general market sentiment surrounding Ethereum remains cautiously optimistic despite the volatility often associated with cryptocurrencies. Many analysts believe that the upcoming transition to Ethereum 2.0 will attract more institutional investors and further solidify Ethereum’s position as a leader in the decentralized finance (DeFi) space. Moreover, increased adoption of non-fungible tokens (NFTs) has also drawn more attention to Ethereum, increasing its usability and, consequently, its price.

However, it’s important to note that the crypto market can be influenced by various external factors, including economic conditions, market speculation, and regulatory announcements. This means that while the short-term outlook appears positive, long-term predictions should always consider potential challenges.

Conclusion

In conclusion, the future of the Ethereum price seems promising, supported by underlying technological improvements and a growing ecosystem. Investors should remain vigilant and stay informed about market trends and new developments to make educated decisions. With rising interest in blockchain technology and cryptocurrencies overall, Ethereum may continue to evolve and thrive in the coming years. As always, potential investors should approach the market with caution and conduct thorough research given the inherent risks involved in cryptocurrency investments.