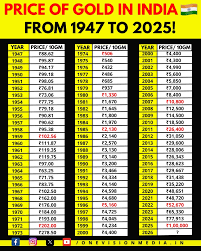

Understanding Current Gold Rates in India – October 2023

Introduction

Gold has always held a significant place in Indian culture and economy. As a symbol of wealth and a traditional investment vehicle, fluctuations in gold rates impact both the consumer market and the broader economic landscape. In October 2023, understanding the gold rate in India can provide insights into market behavior and investor strategies.

Current Gold Rates in India

As of mid-October 2023, the gold price in India is witnessing considerable fluctuations. The rate for 24K gold is around ₹55,000 per 10 grams, while 22K gold is priced at approximately ₹50,400 per 10 grams. These figures represent a slight increase compared to previous months, particularly in September when gold prices averaged around ₹53,000 for 24K gold.

Factors Influencing Current Gold Rates

The gold rates are influenced by several key factors, including global economic conditions, currency fluctuations, and local demand. The ongoing geopolitical tensions and inflationary pressures may drive investors towards gold as a safe-haven asset. Furthermore, the valuation of the Indian Rupee against the US Dollar is directly related; a weaker Rupee generally results in higher gold prices.

Market Trends and Predictions

Analysts believe that the gold rate in India may continue to rise in the short term due to seasonal demand, especially with the upcoming festive season of Diwali. Historically, gold purchases surge during this period as households engage in buying gold for both auspiciousness and investment. However, experts caution that a significant rise in interest rates or a strengthening of the Rupee could counterbalance this upward trend.

Conclusion

In conclusion, keeping an eye on the gold rate in India is crucial for consumers, investors, and the economy at large. With current prices reflecting various global and local factors, it’s advisable for buyers to make informed decisions. As the month progresses, continued trends in gold prices will be closely monitored, and predictions signify potential volatility. Staying updated can empower consumers to maximize their investment associated with gold.