Understanding EPF Withdrawal Rules in India

Introduction

The Employees’ Provident Fund (EPF) scheme is a popular retirement savings initiative in India, crucial for ensuring financial security post-retirement. Understanding EPF withdrawal rules is essential for working individuals who want to make informed decisions regarding their finances. With changes in policy and regulations, it is important to stay informed about the rules surrounding withdrawals, especially in times of need.

Latest Guidelines on EPF Withdrawal

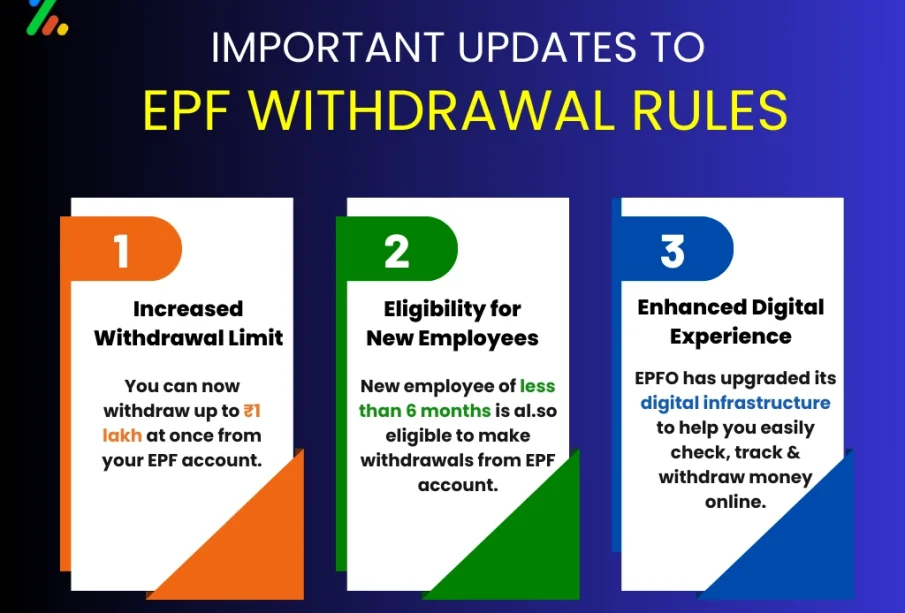

In recent months, the Employees’ Provident Fund Organisation (EPFO) has updated its withdrawal rules to accommodate various needs of the workforce. As per the latest guidelines, EPF members can withdraw their accumulated balance under certain conditions:

- Retirement: Complete withdrawal is permitted upon reaching the age of 58.

- Unemployment: If a member is unemployed for more than two months, they can withdraw up to 75% of their EPF balance.

- Medical Emergency: Partial withdrawal is allowed if there is a medical emergency, subject to documentation.

- Housing: Members can use their EPF balance for purchasing or constructing a house after five years of service.

Moreover, the withdrawal process has been simplified through the EPFO portal, allowing members to submit their requests online. This shift aims to promote transparency and speed up the disbursement of funds.

Eligibility Criteria

To withdraw from the EPF account, members must fulfill specific eligibility criteria. They should be an active EPF member, and the withdrawal must pertain to an account that has been active for at least five years. It’s crucial to ensure that the EPF account is linked with the Aadhaar number for a smooth withdrawal process.

Conclusion

The EPF withdrawal rules have evolved to cater to the changing needs of employees in India. Staying updated on these policies is vital as they can significantly impact financial planning. As more individuals rely on EPF for their retirement solutions and emergencies, understanding the procedures will empower them to make better financial choices. For future forecasts, it is expected that the EPFO will continue to enhance its digital services, making the withdrawal process even more accessible for members while ensuring their interests are protected.