Understanding Sammaan Capital Share Price Trends

Introduction

The share price of Sammaan Capital has attracted significant attention among investors and market analysts. As a key player in the financial sector, understanding its share price trends is vital for making informed investment decisions. The fluctuations in its share price not only reflect the company’s performance but also the overall health of the stock market and investor sentiment.

Recent Trends and Performance

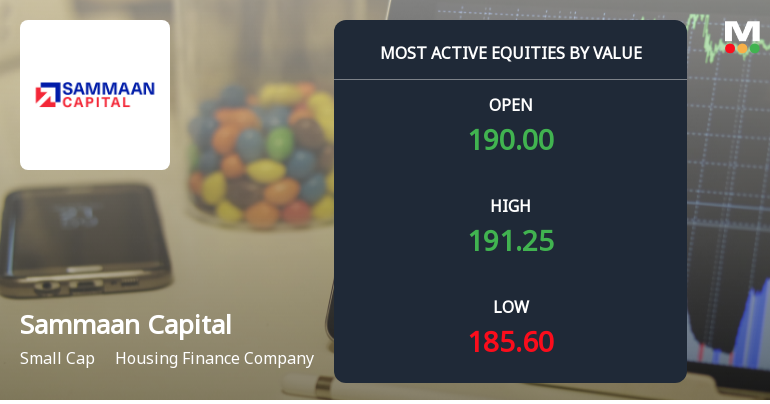

As of October 2023, the share price of Sammaan Capital has shown notable volatility. Starting the month at INR 250, it reached a peak of INR 290 following positive quarterly earnings announcements that exceeded analysts’ expectations. The company’s revenue growth of 15% year-on-year and a net profit margin increase contributed to this surge.

However, the share price experienced adjustments, dipping back to around INR 265 amid broader market corrections and investor profit-booking activities. Analysts believe that these fluctuations might be temporary, driven mainly by market sentiment rather than fundamental weaknesses in the company’s performance.

Market Analysis

Investors have been closely monitoring market indicators that could impact the share price. Factors such as changes in interest rates, economic policies, and competition in the financial sector play a crucial role. Recent reports suggest that the Reserve Bank of India is considering a rate hike, which could affect borrowing costs and subsequently influence the profitability of financial institutions like Sammaan Capital.

Moreover, institutional investors have recently expanded their holdings in the company, indicating strong confidence in its long-term prospects. The shareholding pattern reflects a healthy mix of retail and institutional interest, a positive sign for the future stability of the share price.

Conclusion

In conclusion, Sammaan Capital’s share price has been shaped by a mix of internal performance metrics and external market conditions. For investors, staying updated on both corporate earnings and macroeconomic indicators is essential. As the financial landscape continues to evolve, future growth potential remains high. Analysts forecast that if the company sustains its revenue and profit growth rates, the share price could stabilize and potentially reach new highs in the coming months. As such, monitoring and analyzing these trends will be crucial for investors looking to make strategic decisions regarding Sammaan Capital.