Cipla Share Price: Current Trends and Market Analysis

Introduction

The share price of Cipla, one of India’s leading pharmaceutical companies, has garnered significant attention recently due to its robust performance and strategic initiatives. In the current market scenario, understanding the fluctuations in Cipla’s share price is essential for investors and analysts alike, as the pharmaceutical sector plays a crucial role in India’s economy.

Recent Performance

As of October 2023, Cipla’s share price stood at ₹1,030 per share, reflecting a growth of approximately 8% over the past month. This increase can be attributed to the company’s strong quarterly earnings report, which highlighted a 15% year-on-year revenue growth, driven by increased demand for its generic medicines and a strong export market.

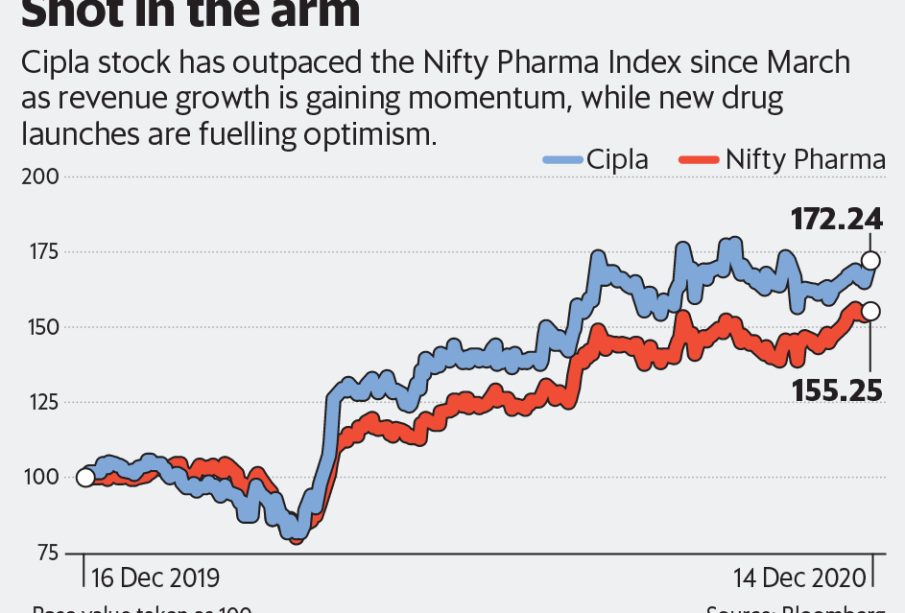

Analysts have pointed to the recent regulatory approvals for new drug formulations as a significant factor contributing to this upward trend. Furthermore, Cipla’s strategic collaborations with leading healthcare institutions and investment in research and development are expected to bolster its market position in the coming years.

Market Sentiment and Future Outlook

The overall sentiment among investors toward Cipla remains optimistic. Market analysts project that the share price could continue to rise, influenced by both domestic and international demand for pharmaceutical products. Cipla’s ongoing efforts to expand its presence in emerging markets, along with its commitment to innovation in drug delivery systems, positions the company well for future growth.

However, potential challenges such as increased competition in the generics market and regulatory hurdles in international markets could impact Cipla’s growth trajectory. Investors are advised to monitor these developments closely to make informed decisions.

Conclusion

In summary, Cipla’s share price reflects the company’s solid performance and growth potential. As the pharmaceutical landscape continues to evolve, staying informed about market trends and company developments will be critical for investors. The next quarterly results and global market shifts will be pivotal in determining Cipla’s position in the stock market moving forward.