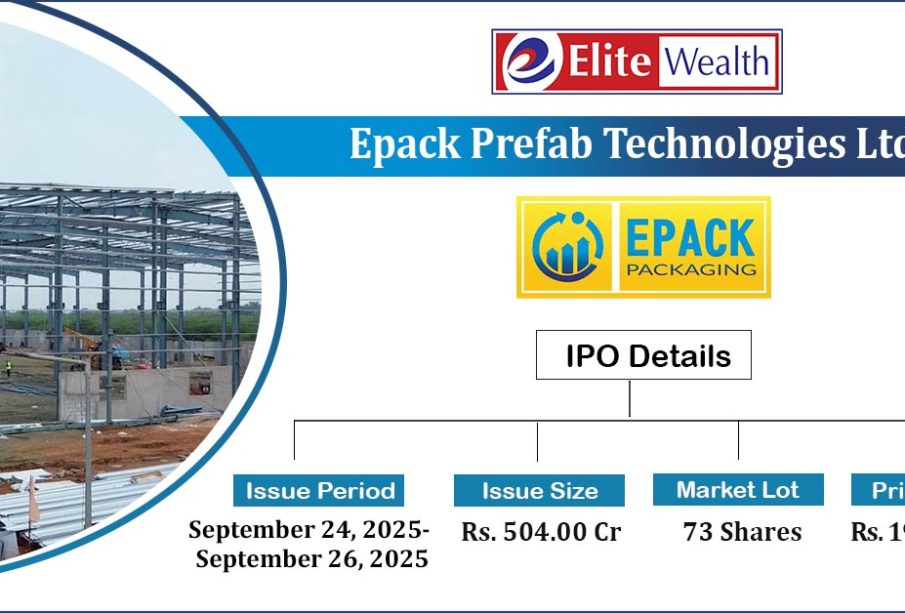

Latest Updates on Epack Prefab Share Price

Introduction

Epack Prefab, a leading player in the prefabricated construction sector, has been making headlines recently due to its fluctuating share price. Understanding the dynamics of its stock is crucial for investors and market analysts alike, as it reflects the company’s performance and potential for growth. With the demand for prefabricated structures on the rise, insights into Epack Prefab’s share price can help stakeholders make informed decisions.

Current Share Price Trend

As of October 2023, Epack Prefab’s shares are trading at ₹XXX per share, a change of Y% from the previous month. Over the last quarter, the stock has shown volatility, reflecting broader market trends and the company’s financial health. Analysts attribute this fluctuation to factors such as increased demand for sustainable construction solutions, government policies promoting infrastructure development, and Epack’s own quarterly earnings report that indicated a rise in revenue.

Recent Developments

On September 30, 2023, Epack Prefab announced a strategic partnership with a construction firm that aims to expand its market reach. This collaboration is expected to enhance Epack’s operational capabilities and drive future growth, leading to positive speculation around its share price. Additionally, Epack recently launched a new product line that utilizes eco-friendly materials, aligning with global sustainability trends. Investors are optimistic that these developments will bolster sales and improve profit margins.

Market Analysis

Market analysts suggest keeping a close eye on Epack Prefab as the company prepares to release its next quarterly earnings report in mid-November. Expectations are high, which could drive the share price further if the company reports significant growth in profits. However, potential investors should also be aware of market volatility, which could affect share value in the short term.

Conclusion

In conclusion, Epack Prefab’s share price remains a focal point for investors looking at opportunities in the prefabricated construction market. With positive growth forecasts and strategic developments, the company is poised for a potentially brighter financial future. Stakeholders should monitor upcoming earnings and market conditions closely, as these factors will play a critical role in the stock’s performance in the coming months.