Bharat Dynamics Share Price: Latest Trends and Analysis

Introduction

Bharat Dynamics Limited (BDL), a prominent player in India’s defense sector, has gained significant attention in the stock market. Understanding the share price of Bharat Dynamics is crucial for investors, analysts, and market enthusiasts alike.

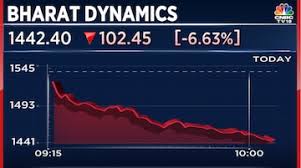

Current Share Price Trends

As of October 2023, Bharat Dynamics’ share price has shown volatility amid broader market conditions. Currently trading around ₹900, it has seen fluctuations due to various factors including quarterly earnings, government policies on defense procurement, and investor sentiment.

Recent Developments Impacting Share Price

In recent months, Bharat Dynamics has secured substantial orders from the Indian Armed Forces, which bolstered investor confidence. The company reported a 25% increase in net profit in the last quarter, driven by robust demand for its missile systems and other defense products.

However, potential investors should consider the geopolitical landscape and its effect on defense spending. The current government’s focus on defense modernization is likely to benefit companies like BDL in the long run.

Market Analysts’ Outlook

Market analysts remain cautiously optimistic about Bharat Dynamics’ future share price performance. Analysts suggest that the share may face resistance around the ₹950 mark but could potentially test higher levels if the overall market sentiment improves. Upgrades from brokerages and anticipated government contracts are pivotal for driving the price higher.

Conclusion

In conclusion, Bharat Dynamics’ share price is influenced by a blend of operational performance, government policies, and market trends. For investors, keeping an eye on upcoming defense contracts and quarterly results can provide valuable insights into future price movements. As the defense sector expands, Bharat Dynamics may present both opportunities and challenges for savvy investors.